Sound financial advice can be life-changing. It can help your clients avoid costly mistakes and keep them on track to their personal goals. Yet, for many over-50s, a financial adviser wouldn’t necessarily be their first source of advice.

Instead, a new study has reported that many over-50s would trust financial journalist, Martin Lewis, rather than working with a financial adviser.

According to research reported by MoneyAge, covering more than 2,000 people between the ages of 50 and 90, people said they would trust the following sources for financial advice:

- 35% – Martin Lewis

- 30% – friends and family

- 29% – their own online research

- 22% – financial advisers

- 15% – bank managers.

Some reported that they felt financial institutions were either not working on their behalf, did not have enough information to address their concerns, or over-promoted certain products to profit from a sale.

However, as much as Martin Lewis can be a useful online source, it is unlikely his advice will be the best option for your clients’ needs.

Read on to discover three reasons why your clients might want to work with a financial planner rather than receive advice from Martin Lewis.

1. Martin Lewis doesn’t understand your clients’ personal circumstances

Martin Lewis is a respected financial journalist and often discusses relevant, hot topic issues. However, his advice is ultimately going to be quite broad and while some individuals might benefit from it, it is unlikely to help everyone.

Martin has no understanding of your clients’ personal circumstances, including their:

- Previous financial experiences

- Personal background and life

- Long-term goals

- Income

- Tax situation

- Savings and investments

- Existing debts and financial obligations.

It is important that the financial advice your clients receive is tailored to their own individual circumstances, tolerance for risk, and goals. Otherwise, it might not actually be working in their best interests.

While Martin Lewis’s advice might help your clients stay informed about financial subjects, it might be a wise move for them to discuss what Martin has brought up with an expert financial adviser. This could help them ensure any decisions arising from it are aligned with their overall plans.

2. Martin Lewis, while well-informed, lacks professional expertise

Martin Lewis is primarily a journalist and, while he’s well-informed on a range of financial topics, he lacks the professional expertise that your clients might get with an adviser. There are many subject areas or finer details of personal finance where Martin might not have an extensive understanding.

Working with a financial planner or adviser is likely to help your clients tap into their experience and knowledge. This might cover a whole range of issues, such as mortgages, investments, tax, or protection benefits.

At Delaunay Wealth, we are proud to have 25 years of experience in the financial sector behind us. We have also demonstrated our continuing levels of excellent service to our clients by being voted among VouchedFor’s Top Rated Advisers in 2021, 2022, and 2023.

A good financial planner can help guide your clients through developing a carefully tailored plan designed to account for their individual circumstances and goals.

So, it is possible that relying on an article from Martin Lewis might leave your clients relying on advice that has become outdated or irrelevant to their specific situation.

3. Your clients can’t develop a long-lasting, mutually beneficial relationship with Martin Lewis

One of the benefits of working with an expert financial adviser is that your clients’ can develop long-lasting, mutually beneficial relationships. This can have a range of emotional wellbeing benefits.

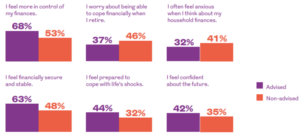

According to a study by Royal London, individuals who worked with a financial adviser reported a range of better outcomes compared to the non-advised, as shown by the graphic below:

Source: Royal London

The study also found that the benefits were even greater for those who developed long-lasting relationships with their advisers over individuals who sought out advice only once. As much as Martin Lewis might help keep your clients informed, they’re unlikely to develop personal, mutually beneficial relationships with him.

Read more: Why it’s important your clients don’t take financial advice from AI

Get in touch

If your clients are mistrusting of financial experts and are opting to receive their advice primarily from online sources, it might be worth introducing them to Delaunay Wealth to see if we can start the process of building trust.

It could greatly benefit your clients’ financial outcomes.

Read more: We’re officially a Top Rated firm!

The first step is to set up a meeting so we can get to know them and their personal circumstances. They should reach out by emailing mail@delaunaywealth.com or calling 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production