The pursuit of happiness is a notion that drives many of us to work hard and generate wealth, in the hope that we can live a decent quality of life and build towards achieving our long-term goals.

So, it’s understandable that the past few years of high inflation, global uncertainty, and a cost of living crisis have made many feel unsure about their short- and long-term futures.

According to the Guardian, 30 million Brits could be priced out of a decent standard of living by 2024 as rising costs, and a myriad of additional financial pressures, have shrunk disposable incomes and put a strain on household budgets.

It is important to remain calm. While economic downturns can be concerning, there are always potential solutions to consider that could protect your wealth from the worst effects of short-term volatility.

Read on to learn about the standard of living crisis that looms for many British households and four ways you can protect your savings to stay on track to meet your long-term goals.

43% of UK households face the prospect of being priced out of a decent standard of living by 2024

A study by the think tank New Economics Foundation (NEF), has determined that rising costs, the likelihood of increasing unemployment, and the wage stagnation of the past few years, could cumulatively result in 43% of UK households — almost 30 million people — being priced out of a decent standard of living.

Work done by the Joseph Rowntree Foundation (JRF) provides the basis of the NEF’s definition of a decent standard of living, derived from research into what people in the UK consider to be an acceptable minimum. The JRF cites eight key factors that include:

- Housing

- Food and drink

- Clothing

- Household goods and services

- Domestic fuel

- Healthcare costs

- Transportation and travel

- Social and cultural involvement

The worst effects of the current standard of living crisis will likely be felt by lower income households on a far greater scale, but the problems that are created by high inflation, wage stagnation, and the possibility of redundancy are likely to affect families across all demographics to some degree.

4 proactive ways to ensure a decent standard of living by working to protect your wealth

1. Review the state of your savings and ensure you have an emergency fund set aside

During periods where high inflation outpaces interest rates, the “real” value of your wealth can be eroded over time. This is because the cost of goods and services year-on-year increases by more than any growth generated on savings thanks to low interest rates.

So, to protect your wealth it might be worth firstly considering if you can move your funds into a better savings account, before considering the benefits of establishing an emergency fund of at least three months’ worth of essential bills.

This may help protect you and your family should the worst occur — as well as provide a boost to your peace of mind.

The fund would ideally ensure you are covered in the short term for bills such as:

- Rent/mortgage

- Utilities

- Taxes

- Groceries

These vital savings could help resolve any short-term cashflow issues if unexpected problems arise.

Once your fund has been established, it may be worth considering investing any surplus funds to generate the growth needed to mitigate the eroding effects of inflation on your wealth.

2. Reconsider your debt obligations such as mortgage agreements or loans

If your outgoings are out of balance and aren’t being managed efficiently, it can be easy to find yourself struggling to pay for the standard of living you desire.

Rising interest rates can quickly make debt obligations unmanageable if you are exposed to the fluctuations associated with a variable- or tracker-rate mortgage or a similarly vulnerable loan agreement.

This might cause your monthly payments to rise sharply in the short term, which could put added pressure on your outgoings. It may also create a bigger financial burden as the overall cost of your debt increases.

It could be a smart move to discuss whether changing to a fixed-rate agreement might be beneficial to your plans in the short and long term.

3. Ensure your income is protected

If you are worried about the prospect of redundancy, insurance could be a lifesaver.

Economic downturns can lead to significant increases in unemployment. Income protection insurance can provide a valuable lifejacket should the worst occur and is one way you could help yourself navigate the problems presented by a recession.

Specific forms of income protection cover protect against the possibility of redundancy and can provide an income for you should you face unemployment. It will normally also protect part of your income if you’re off work for an extended period due to illness or injury.

The cost of cover may depend on your lifestyle, health, and the desired length of coverage. It may be an additional outgoing, but it could also provide a reassuring safety net.

4. Contemplate investing your surplus funds to generate the growth needed to unlock your desired lifestyle

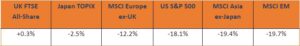

Stock markets around the world endured a volatile period across 2022. The table below shows the performance of a few of the leading global stock indices in the year to the end of December 2022.

Source: JP Morgan

It is evident that markets can be unpredictable during periods of turmoil such as a cost of living and energy crisis. However, over the long-term patient investing can see positive returns. Indeed, IG report that the median annual return for the UK’s leading stock index — the FTSE 100 — was 8.43% with dividends reinvested for any 10-year period between 1984 and 2019.

So, once you’ve secured your savings and considered your outgoings, it may be worth investing your surplus funds. This can help you to generate the growth needed to keep you on track to meet your long-term goals and ensure you are able to live the lifestyle you desire.

Get in touch

Periods of instability can be worrying for many households. But a smart, carefully tailored financial plan could help navigate many of the problems you might face.

If you are interested in learning more, you should contact us by email at mail@delaunaywealth.com or call us on 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production