Individual Savings Accounts (ISAs) allow you to invest in cash and shares up to a value of £20,000 (2023/24) without paying any Income Tax or Capital Gains Tax on your interest or returns.

According to research published by This is Money, the number of savers with an ISA worth more than £1 million has increased fivefold since 2017, to 2,760.

If you think becoming an ISA millionaire is out of reach, read on to find out five inspiring tips for increasing your chances of hitting this impressive savings milestone.

1. Use your full ISA allowance every year and start as early as you can

The more you invest, the more potential your money has to grow. So, if you want to become an ISA millionaire, you’re likely to need to fully use your annual ISA allowance (£20,000 in 2023/24) every year.

There are three main types of adult ISA:

- Cash ISA – a tax-efficient cash savings account that pays tax-free interest on your savings.

- Stocks and Shares ISA – enables you to make investments in shares and funds without paying Income Tax or Capital Gains Tax on any profits made.

- Lifetime ISA – designed to help people aged 18 to 39 to save for their first home or for retirement. The government pays a 25% bonus on your savings.

Every tax year you can put money into one of each kind of ISA provided you meet the eligibility criteria for each type and the total invested does not exceed the £20,000 limit.

You can only pay a maximum of £4,000 into a Lifetime ISA in a single tax year, otherwise you can split your savings across accounts as you wish, or hold them all in one type of ISA.

Becoming an ISA millionaire takes time. According to data published in IFA Magazine, the average age of an ISA millionaire is 74. So, start investing as early as possible if you want to hit this savings goal.

You might find it easier to pay in a small amount each month rather than large lump sums. Making regular contributions will quickly add up – the key is being consistent. Automating contributions to your ISA each month is a clever way to ensure that you stay on track with your financial goals.

2. Invest in Stocks and Shares ISAs

It will be more difficult and take you longer to become an ISA millionaire if you rely solely on Cash ISAs, because interest rates on cash are typically lower than the returns generated by stocks and shares.

Figures published recently in FTAdviser revealed that nearly all ISA millionaires are equity investors.

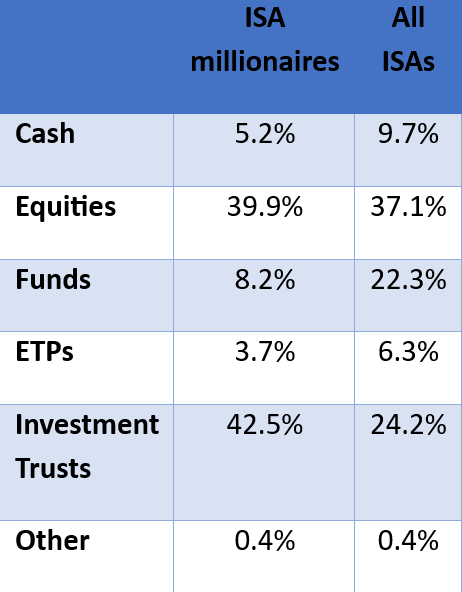

The table below shows how ISA millionaires’ holdings compare to all ISA holdings:

Source: MoneyWeek

While investing is generally higher risk than saving in cash, over the long term, investing in the stock market offers the potential for greater growth, meaning you could become an ISA millionaire sooner.

And, with the help of a financial planner, you can develop an investment strategy that suits your preferred level of risk.

3. Spread your risk by diversifying

If you put all your money into one company, region or asset type, any losses could potentially have a significant impact on your portfolio.

By investing in a range of asset classes you can diversify the risk. If one asset decreases in value, another asset making a gain can compensate for this.

The table above shows that many ISA millionaires invest in a mixture of cash, equities, funds, Exchange-Traded Products Funds (ETPs), investment trusts, and other asset classes.

4. Reinvest any money you earn

As the value of your ISA grows, it’s likely you’ll benefit from interest or dividends.

Reinvesting these dividends – rather than taking them as income – can enhance the growth potential of your investments, especially as compound returns build over time.

5. Set mini milestones

Becoming an ISA millionaire is a huge financial goal and one that typically takes many years of patient and consistent investing to achieve.

To keep yourself motivated long term, try setting mini milestones that you can check off along the way. For example, set a target amount to reach in your first five years and reward yourself for achieving it.

Passing the £1 million account balance in your ISA accounts is not a get-rich-quick scheme. Slow and steady wins the race!

Get in touch

If you’d like to know more about how to grow your wealth, we can help. Please email us at mail@delaunaywealth.com or call 0345 505 3500.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production