When chancellor Rachel Reeves delivered her 2024 Autumn Budget, she announced two big changes for employers:

- Employers’ National Insurance contributions (NICs) will increase from the current rate of 13.8% to 15%, from April 2025

- The threshold at which employers become liable to pay NICs will be reduced from £9,100 to £5,000 from April 2025

Combined, these two changes are expected to raise £25 billion a year in government revenue and, if you’re a business owner with employees, you’ll have to meet significantly higher payroll costs.

Speaking to delegates at The Yorkshire Post’s great northern conference earlier in December, Rachel Reeves said: “I’m not going to pretend that it’s going to be easy for businesses, or indeed for charities or local authorities, to absorb, especially, the national insurance increase.”

And she’s right…

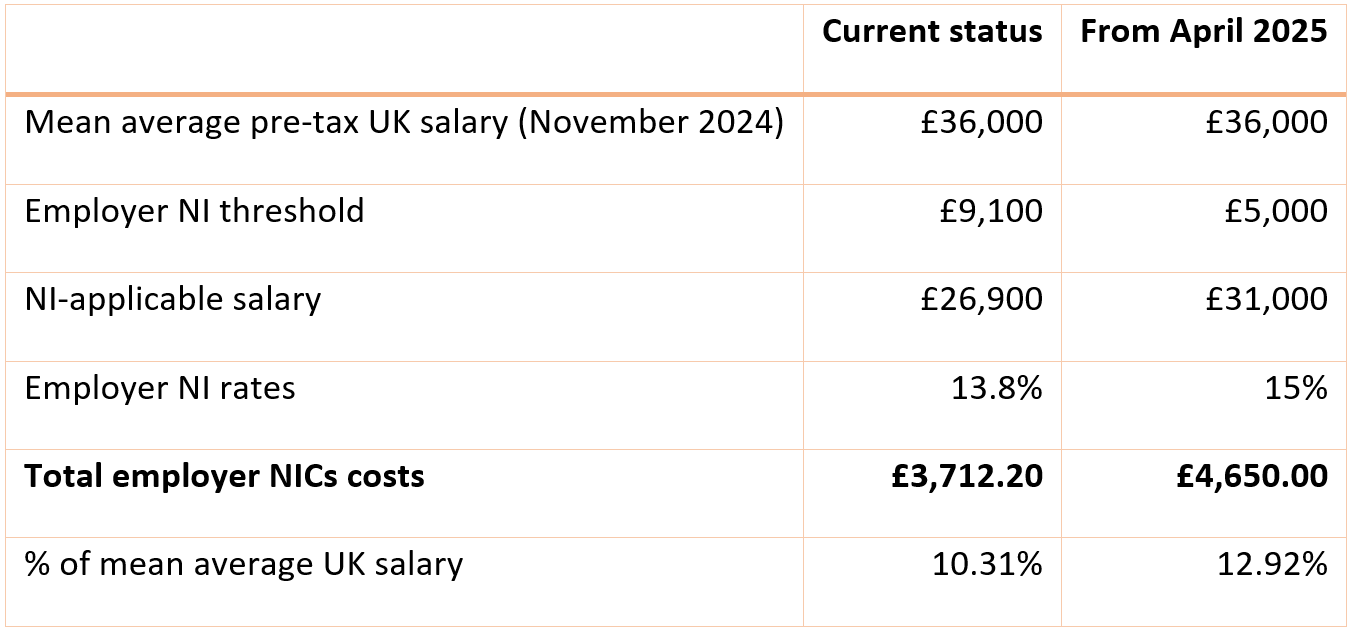

According to government data, the mean average UK weekly wage in November 2024 is £36,000 a year. Take this figure and compare it to current employers’ NICs costs with the future costs following the NICs increase, and the impact is clear to see:

Employers could save money by offering a salary sacrifice scheme

One immediate way you could look to offset the increased burden of employer NICs is to introduce a salary sacrifice scheme.

Through salary sacrifice, employees give up a portion of their pay and so typically end up paying less Income Tax and lower NICs, meaning more money in their pay packet.

As the name suggests, salary sacrifice allows your employees to sacrifice – or exchange – a proportion of their salary for an additional employee benefit. The key employee benefits that can generate an employer NICs saving are:

- Pension salary sacrifice

- A cycle-to-work scheme

- A company car

- Childcare vouchers

Pension contributions, in particular, could make a significant difference to your employees’ long-term financial wellbeing. And yet, according to research by Workplace Pensions Direct and YouGov, in 2023 only half of UK businesses used salary sacrifice for pension contributions.

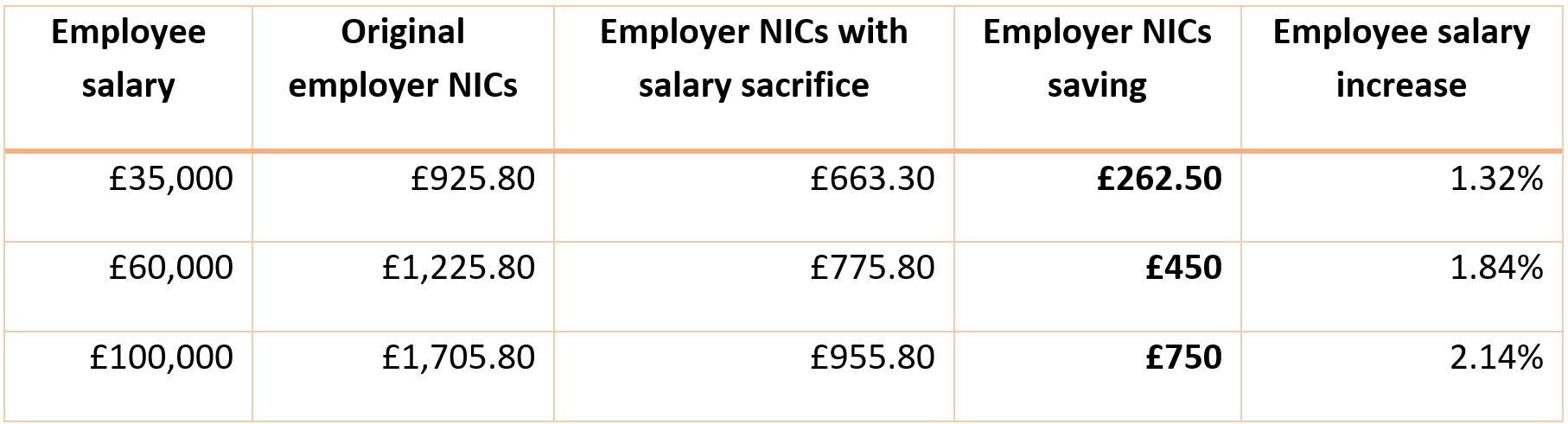

Figures quoted in an inews report show how much both employers and their workers could save if an employee paying 5% in pension contributions opted to shift to salary sacrifice:

As ever, there are some potential drawbacks to consider

Although the benefits are far-reaching, salary sacrifice may not be appropriate for everyone.

For some employees, a lower salary could be detrimental. Increasing the amount of money in their pay packet could affect their eligibility for means-tested benefits.

Some state benefits, including the State Pension, are connected to salary. So, in the event that joining a salary sacrifice scheme took an employee below the NICs threshold, this could prove problematic.

That is why we are on hand to help ensure that all the pros and cons are communicated clearly to every employee. We’ll make sure everyone has the necessary information to help them make the right decision for them.

We are here to help you and your business owner clients

If you have business owner clients who are concerned about the impending NICs rises, please get in touch.

From assessing a range of suitable salary sacrifice schemes to calculating the financial benefit for the business and its employees, we can provide complete advice, tailored to the needs of your client.

Once we’ve helped to establish the right salary sacrifice scheme, we’ll then support you in communicating the benefits to employees, encouraging them to opt in.

Where appropriate, we can arrange one-to-one meetings with employees to explain how a salary sacrifice scheme would affect their finances and more fully demonstrate the value to individuals.

Get in touch

With the upcoming NI increase looming, salary sacrifice is one way your business clients could better manage the increased costs while offering employees a tax-efficient way to get more from their workplace perks or grow their pensions.

Please email mail@delaunaywealth.com or call us on 0345 505 3500 to find out more.

Please note

The information contained in this article is based on the opinion of Titan Wealth Planning and does not constitute financial advice or a recommendation for any investment or retirement strategy.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Workplace pensions are regulated by The Pension Regulator.

Production

Production