On 5 November, Americans will go to the polls to decide their next president.

Until mid-July, the contest looked to be between the 45th and 46th incumbents: Donald Trump and Joe Biden. However, after a disastrous performance in a TV debate, Biden withdrew his candidacy and backed his vice president, Kamala Harris.

The polls show that the race may be too close to call, although, as of 11 September, Harris has a slight lead with weeks left to go before polling day.

Source: Economist

The US presidential election of one of the world’s major news events – so what effect will it have on markets? Read on for a historical perspective.

The presidential election is not a “market-moving” event

The first point to consider is that the US stock market has generally performed well in an election year – irrespective of the candidates or the potential outcome.

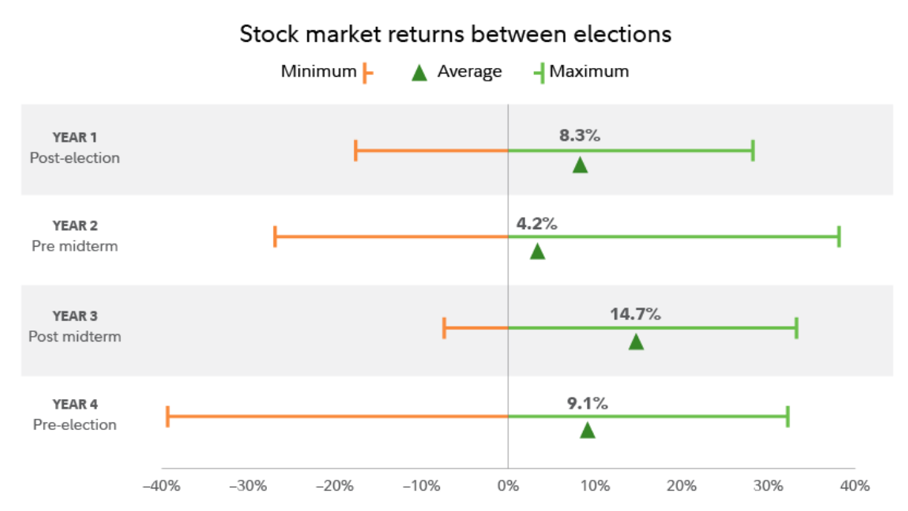

Research by Fidelity reveals that, since 1950, US stocks have averaged returns of 9.1% in election years.

Source: Fidelity

You might think that an event designed to elect the most powerful person in the world may be a major contributor to stock market movements.

However, the search shows that, in the 12 months preceding a presidential election, the average return isn’t substantially better or worse. Consequently, Fidelity concludes that the presidential election is not a notably “market-moving’ event”.

Democrat winners generally lead to higher returns than Republicans

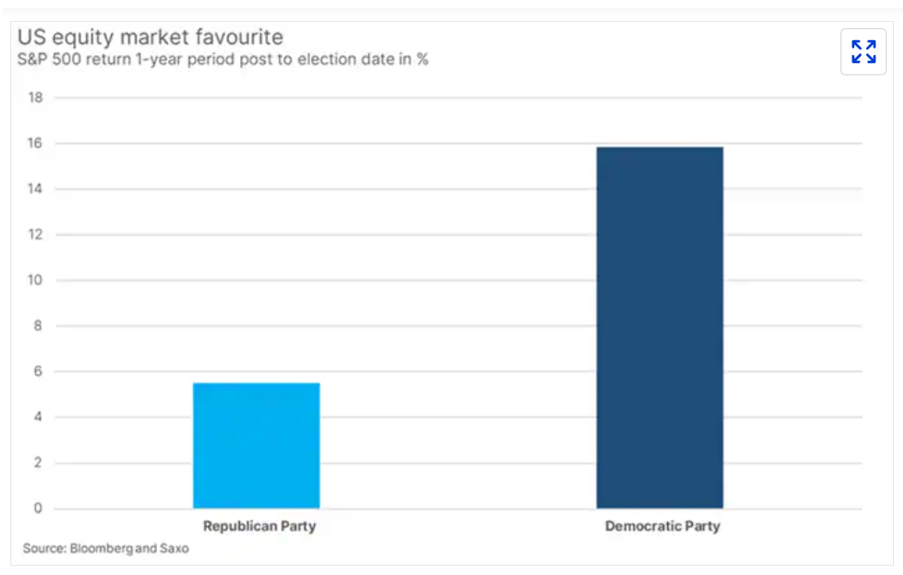

Research by Saxo Bank looked at whether stock markets prefer a Republican or Democratic president. They looked at S&P 500 returns in the year following the election date from 1972 to 2020 – the chart below shows their findings.

Source: Saxo Bank

Firstly, you’ll note that returns were, on average, positive irrespective of the eventual outcome.

However, you’ll see that returns tend to be higher one year after the election if a Democratic president is elected. So, a Kamala Harris victory looks as if it should lead to more positive returns.

However, Saxo Bank says that “it is important not to view this in a vacuum, as these results are to a certain extent the result of outlier years such as 1976, 1996, and 2020” and that “markets have performed better with a Democratic president than with a Republican […] although it seems to be skewed by events unrelated to party politics”.

Economic factors are more important to the markets than the election

While your clients may be keeping a close eye on the election result for its effect on the value of their portfolios, US Bank found that other factors may have a greater impact on the value of their holdings than the outcome of the poll.

They conclude that “economic and inflation trends, more so than election outcomes, tend to have a stronger, more consistent relationship with market returns”.

Generally speaking:

- Rising economic growth and falling inflation have been associated with returns that are considered above long-term averages.

- Falling growth and rising inflation have corresponded to positive but below-average market returns.

For investors, it means that staying focused on these patterns is likely to be more insightful than potential election outcomes when it comes to forecasting market performance. This brings us to…

Staying invested is generally the way to generate positive returns

One of the pillars of a sound investment strategy is to focus on long-term objectives.

Regular trading in line with market movements and geopolitical events can lead to higher trading fees and the potential for lower returns.

As an example, IG research showed that if an investor simply missed the best 10 days of the S&P 500 from 1994 to 2023, their return would have been an eye-watering 54% lower than being fully invested for the entire period.

If they had missed the 30 best days, their returns would have been a staggering 83% lower than being fully invested over the period.

Consequently, investing for a long period has historically been a more successful strategy for generating a long-term return than trying to time politics and elections.

Source: IG

You may have heard the investing mantra: “It’s time in the market, not timing the market that counts”.

Rather than trying to predict the outcome of an election and the effect it might have on stock markets, investors are generally better served by creating a long-term financial plan that’s aligned with their goals and aspirations – and sticking to it.

As Jurrien Timmer, Fidelity’s director of global macro, concludes: “Elections tend to have less impact on the markets than politicians may like to believe.”

Get in touch

If you have clients who would benefit from advice from an experienced financial planner and investment manager, we can help.

Please email us at mail@delaunaywealth.com or call 0345 505 3500.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production