The self-employed benefit from a wide range of lifestyle advantages. Your clients might enjoy perks such as flexibility over their working schedule, having control over who they work with or being their own boss.

However, there is also the pressure of added responsibility. If your client is reporting to an employer, then they will have employment benefits taken care of on their behalf including, normally, being enrolled into a workplace pension scheme.

It can be very easy for someone who is self-employed to take their eye off the ball and overlook the importance of their pension contributions.

A study by the Social Market Foundation reports that, on average, Britons approaching retirement are approximately £250,000 short of the pension pot needed to meet their desired retirement goals.

The report goes on to mention that only 31% of those surveyed have an accurate understanding of how much they’ll need to save for their desired level of retirement comfort. Just 20% of people with pensions have sought out and received independent regulated financial advice.

Being self-employed can leave your clients especially exposed to a potential pension shortfall and receiving financial advice could help keep them on track to meet their long-term goals.

Discover how receiving the right financial advice could potentially give your clients a helpful pension boost before retirement.

The majority of self-employed people in the UK aren’t saving into a pension

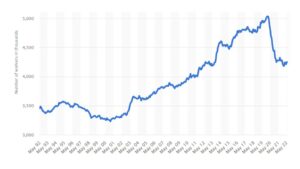

Over the last 30 years, the number of self-employed workers in the UK has grown from approximately 3.45 million in 1992 to 4.25 million in 2022, making up approximately 15% of the UK workforce.

Source: Statista

While there was a significant dip during the onset of the pandemic as workers looked for the stability of a workplace income, the amount of self-employed workers is beginning to rise once more.

According to data from the Association of Independent Professionals and the Self-Employed (IPSE), as few as 31% of self-employed people are saving into a pension.

The average age of self-employed individuals is 46, which means that they are potentially 20 years away from retirement and possibly facing a retirement income shortfall.

When polled on how they save from a list of the most commonly used saving options (such as pensions, ISAs, stocks and shares or bonds), 39% responded “none of the above”. This suggests that potentially more than a third of the self-employed could have no savings whatsoever.

A smart financial plan could make a huge difference for your self-employed clients and help them get back on track for meeting their retirement goals.

Financial advice may give your clients a greater understanding of how to reach their goals

One of the key differences between the self-employed and the employed is that they are essentially more involved with the operation of their own business. This can mean that far more of their time and money is focused on their work needs rather than their long-term personal requirements.

Financial planners work towards developing a plan that is personally tailored towards each client’s personal circumstances and long-term goals.

Beginning by establishing exactly what a client’s long-term ambitions are, we build a plan that is designed to help them take the steps needed to get there – whether that is by saving more, investing more tax-efficiently, or taking adequate protection.

Working with a financial planner also has a range of emotional wellbeing benefits. The anxiety of managing their personal finances is taken off your client’s shoulders and they are freed up to focus solely on the needs of their business.

The relationship between a financial planner and a client is long-term. It is about fostering a level of trust that can take give your clients peace of mind and leave them with the knowledge that they are still on track to meet their long-term objectives.

If your client is concerned about their retirement but also doesn’t know how they can afford to contribute into their pension, working with a financial planner can help them assuage those worries.

Working with a financial planner could boost your client’s retirement outcomes

The IPSE study referenced above goes on to state that 67% of the self-employed are concerned about being prepared financially for later life.

If your client is one of the minority of self-employed individuals with an existing pension, then making the decision to cut or stop their contributions as financial pressures increase during the current cost of living crisis and looming recession could have detrimental results come retirement.

New research from Legal & General shows that, if a client was to stop making pension contributions in their early 50s, then they are likely to find themselves at least £50,000 worse off come retirement if they never opted back in and continued working full-time throughout.

If your client has no pension provision in place, then meeting with a financial planner and building a well-calculated plan could be life-changing.

There are a few ways a financial planner can help boost your client’s retirement savings:

Improve their tax efficiency

Pensions are an incredibly tax-efficient method of saving. At an individual level, your clients could receive tax relief of 20% of their contribution if they are a basic-rate taxpayer. The benefits are even greater for higher- or additional-rate taxpayers.

Pension contributions can also often be considered as a business expense, which could cut their Corporation Tax bill. Pension contributions from the business can also help clients reduce their National Insurance contributions.

Maximise existing pension pots

If your client has existing pension pots from previous employment built up, then consolidating the various schemes may end up reducing potential charges, meaning your client keeps more money.

However, there can be downsides so it can pay to seek advice.

PensionsAge reports that 1.6 million UK savers have lost or dormant pensions working out on average as about £23,000 a saver.

It is possible for your client to trace lost workplace pensions and potentially unlock dormant funds that may have been accruing added value.

Use their established self-employed business to delay retirement

Finally, many retirees may look to move into self-employed or part-time employment in order to make up a pension shortfall as they approach retirement.

Your self-employed clients will be one step ahead in this regard and will be uniquely set up to enter a state of “semi-retirement” by reducing their workload to part-time status and keeping an income flowing.

Get in touch

The self-employed are exposed to a higher degree of risk of not reaching their retirement saving goals. A smart financial plan can boost your client’s options and give them peace of mind.

If you have clients who would benefit from advice, or you’re interested in working more closely with us, please email mail@delaunaywealth.com or call us on 0345 505 3500.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production