There have been plenty of worrying comparisons to the 2008 financial crisis in recent months with the threat of a recession, mortgage market instability, and the most recent banking news. However, there is one comparison that is giving savers a reason to be optimistic — rising annuity rates.

According to MoneyWeek, annuity rates rose 44% in 2022 to hit a 14-year high. The last time rates were this high was in 2007/08.

An annuity can be an incredibly safe and secure way to provide yourself with a guaranteed income that will last throughout your retirement. However, they have their own set of pros and cons that should be considered before opting for one.

Read on to learn about annuities, why the rates are so high right now, and how they could help support your retirement plans.

An annuity is paid to you on a regular basis throughout retirement

Perhaps the biggest advantage of acquiring an annuity is its reliability. Annuities are purchased from providers for a lump sum, who in turn agree to pay you a regular income once you retire — normally guaranteed for the remainder of your life.

If you live for a long time, you’ll likely get more back than you initially paid.

The size of your annuity income will likely be dependent on several factors including:

- Your age at the time of purchasing

- Your current health

- The type of annuity you choose — for example, if you want your annuity to continue to provide your spouse or partner with an income after you die

- The provider’s annuity rates at the time of buying.

There are many kinds of annuities, all with their own special set of added benefits. It is important to shop around before deciding to purchase one.

Annuities have been boosted by soaring gilt yields and rising interest rates

The performance of government bond yields, also known as “gilt yields”, and the Bank of England (BoE)’s base rate directly influences annuity rates. As a result of soaring gilt yields and the base rate rising to 4.25% (23 March 2023), annuities have hit their highest average rate since the 2008 financial crisis.

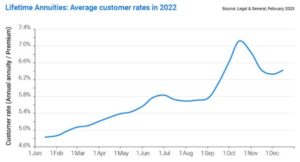

Legal & General figures show that lifetime annuities have seen their average annual rate grow from around 4.8% in January 2022 to approximately 6.4% in February 2023, as shown by the graph below:

Source: Legal & General

Meanwhile, Hargreaves Lansdown tracks the best annuity rates available across the UK’s leading providers and, as of 16 March 2023, reported annual rates for a £100,000 pension as high as 8.64% or £8,643, dependent on age.

The sharp rise in annuity rates have boosted the benefits of owning an annuity.

For example, it means a 65-year-old who buys an annuity (single life, level, no guarantee) worth £100,000 would now receive a guaranteed income of £6,340 a year, compared to someone at the start of 2022, who at a rate of 4.8% would likely have earned around £4,800 a year.

This also effectively reduces the break-even point, at which a buyer would receive their full initial outlay back through pension income, from nearly 21 years to around 15. Anything beyond that is profit.

It is important to remember to shop around for the best annuity rates on offer as the gap between the top and bottom of the market can be significant.

The pros and cons of purchasing an annuity

Annuities can provide a great degree of reassurance and stability during retirement and the currently favourable market conditions could make purchasing one now especially desirable. However, they do come with their own set of downsides too.

The benefits of owning an annuity

An annuity is likely to provide you with a 100% secure income for life, that isn’t reliant on stock market performance or the amount of funds left in your pension pot.

As annuities are purchased rather than drawn from, you could acquire one, and still retain funds in your main pension pot to use in alternative ways — offering you the security of an annuity and the flexibility of a regular pension pot.

You aren’t required to own an annuity upon retiring and can opt to purchase one later in life when rates are likely to be even more favourable as they typically increase with age. You can also continue to contribute to your pension scheme, even after purchasing an annuity.

The downsides of annuities

Annuities are a form of fixed income and don’t offer a great degree of flexibility. They may not provide enough for your retirement outgoings, and unless you purchase special provisions (which can be expensive) they are unlikely to increase in line with inflation.

An annuity counts as taxable income, so you may find yourself facing potential liabilities during retirement.

It should also be noted, that if the worst occurs and you die “early”, you may not earn back the full amount of your annuity purchase.

It is important that before you make any major decisions regarding your retirement plans, you consult your financial planner on the best steps for your personal circumstances.

Get in touch

Ensuring you have a stable and reliable income during retirement can be a smart way of boosting your emotional and financial wellbeing. Annuities could be a way of achieving that.

However, before opting to make a significant outlay, you should seek advice from a financial planner by contacting us at mail@delaunaywealth.com or calling 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Production

Production