The recent energy crisis has been a worry for many UK households as they’ve been forced to reconsider their budgets and factor in what rising costs may mean for them. For anyone concerned about soaring bills, there was some good news at the start of the autumn in the form of the Energy Price Guarantee (EPG).

The energy price cap was expected to increase for the second time in 2022 on 1 October. This would have resulted in a rise of 80%, but the government’s EPG bill superseded those costs and was intended to freeze UK household energy bills for the next two years.

However, in the weeks since, we’ve seen a change in both prime minister and chancellor, which has led to changes to recent government budgetary plans and plans for the EPG.

Read more: After months of political unrest and budget reversals — what has actually changed?

But what is the energy price cap and how does it affect UK households? How does the EPG protect Britons from the worst effects of rising energy costs? And what are the new government’s plans relating to the price cap in the future?

Read on to discover the key facts you’ll want to know about the energy price cap, the EPG, and any changes in recent weeks, so you can plan accordingly for any additional costs down the road.

The energy price cap was designed to protect consumers from energy firms acting in bad faith

The price cap was introduced on 1 January 2019 by regulator Ofgem. The cap was intended to protect millions of UK consumers from the possibility of energy companies acting in bad faith and potentially ripping them off with unnecessarily expensive variable energy tariffs.

The cap limits set a maximum daily standing charge (the fee associated with having your home or business connected to the energy grid), as well as the amounts you pay for each unit of gas and electricity that you use.

Normally the cap works as intended. However, due to the current global energy crisis, the energy price cap has risen at an unprecedented rate.

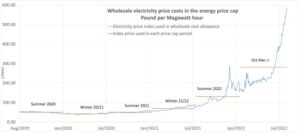

The wholesale prices for gas and electricity have soared at an alarming rate over the past few months as shown by the graphs below:

Source: Ofgem

The rising costs have, in turn, pushed Ofgem to raise the energy price cap.

According to Ofgem, the energy price cap was raised by 54% on 1 April 2022 and was due to rise again on 1 October 2022 with estimates for the autumn increase putting the latest increase at 80% or a cost of approximately £3,500 a year to the average UK household.

Luckily, the government stepped in and introduced the EPG as a means of tackling the issue, which originally planned to freeze energy bills for the average UK household at £2,500 a year for the next two years.

This would be in addition to the £400 energy bills discount that had already been outlined for UK households this winter.

The EPG was intended to give Britons breathing room in the face of rising energy costs

Unlike other recent government policies, the EPG was largely met with universal approval. It would give households two years of frozen energy prices and precious time to prepare for future changes for both households and the government alike.

The government’s EPG mantra was that bills would be capped for the average UK household at £2,500 a year.

However, how it defines the “average UK household” determines how much you could end up paying on your energy bills.

As mentioned, the energy price cap is based on the maximum energy suppliers are allowed to charge households for every unit of energy they use (which is worked out as kilowatts per hour).

Under the EPG, your average UK household is worked out as 2,900 kWh of electricity and 12,000 kWh of gas consumption a year.

This means that if you own a larger than average home you may exceed the EPG’s parameters and still end up paying more than £2,500 a year on energy bills. Alternatively, if you own a smaller home, you may end up paying less.

The BBC reports that a one-bedroom household or small apartment might expect to pay around £1,700 a year, while a five-bedroom home is likely to be closer to £3,500 a year.

The government scheme was estimated to cost between £130 billion and £150 billion, funds raised through additional borrowing, and has added to the public finance black hole the new regime led by Rishi Sunak and Jeremy Hunt is now seeking to plug.

The funds borrowed for the EPG will eventually need to be paid back — with interest. And this cost is likely to fall onto UK taxpayers in the future.

The new chancellor has dialled back the EPG

This is Money reports how Jeremy Hunt’s plans to end the EPG in April 2023 could have seen UK household energy bills rise by as much as 73% next year.

The increase in costs would have seen the average home paying around £4,334 a year on energy bills — more than double what it was in March 2022.

It can make for a worrying picture for your future finances, but don’t panic!

The new government are still settling into their roles and have only just outlined their financial plans with the recent budget update.

Hunt announced on 17 November 2022 that the government’s EPG would now continue past April 2023 but in a reduced capacity. The EPG as of April 2023 will rise from £2,500 to £3,000 and continue for a further 12 months, meaning households will likely see their energy bills rise again next spring.

Protect yourself by setting aside an emergency fund for worst-case scenarios

It is always wise to be prepared for a rainy day. But the current state of affairs may make preparing an emergency fund even more of a priority.

You’re likely to want to save the cash value of three months of key bills such as rent, utilities, and important household groceries.

If you have any surplus cash beyond that, it may be prudent to consider investing your funds. This could generate greater growth than leaving excess cash sitting in your savings account.

The future may seem daunting, but by acting proactively and preparing for possible outcomes, you can make sure you stay on track to meet your long-term goals.

Get in touch

If you have any concerns about rising household costs and want to discuss how your plan can help you navigate any potential issues, please contact us at mail@delaunaywealth.com or call us on 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production