2022 was a volatile year for stock markets around the globe as political and financial instability contributed to market dips and rises.

High inflation, rising interest rates, and the underperformance of traditionally secure assets all influenced a particularly tricky period for investors.

However, there are plenty of positives to take from the lessons of 2022, and there is the potential for good news in the future.

Read on to discover four promising reasons to be upbeat this year, despite any ongoing investment worries.

2022 saw the majority of the globe’s major stock indices post annual losses

The previous year saw global stock markets influenced by macroeconomic factors such as the global energy crisis, pandemic, and war in Ukraine, which have caused issues for businesses around the world.

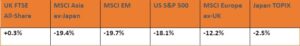

The table below shows the performance of some of the globe’s major stock indices in the year to the end of December 2022.

Source: JP Morgan

It is evident that stock markets can be especially volatile during periods of rising interest rates, high inflation, and economic downturn — and this can naturally cause concern.

However, you can see from the data that the UK’s FTSE All-Share index saw slight positive returns over 2022, while the UK economy was in decline, despite other stock indices posting losses.

1. A diversified portfolio can protect your investments and keep you on track to achieve long-term growth

A well-diversified portfolio is designed to protect your investments from short-term fluctuations by offsetting any losses with gains elsewhere, as shown by the differing performance of global stock markets.

2022 was a notably tricky year to navigate, as according to interactive investor, only 3 out of 13 asset classes managed to produce positive returns for the year.

For example, UK property and bonds had a particularly difficult year, but commodities performed well, with hard commodities such as oil and gold, and soft commodities such as wheat and coffee seeing positive returns.

Currencies saw similar differing outcomes with the pound suffering a difficult year, in part due to the autumn’s “mini-Budget” announcement, while the US dollar had a strong year.

In simple terms, there were losses in some areas and gains in others, so a diversified portfolio would have been likely to have seen the two mitigate each other.

Working alongside a financial planner, you can ensure your portfolio is designed with diversification in mind.

Doing so means you can rest assured that, despite any short-term instability, the overall performance of your investments is likely to maintain growth and keep you on track to reaching your long-term goals.

2. Short-term downturns can offer investing opportunities

As stock markets dip, opportunities can present themselves. Traditionally stable and valuable commodities and equities may find themselves priced lower than expected and offer a chance to invest for a smaller outlay or expand upon an existing investment.

According to interactive investor, it is one of the key reasons why many investors are feeling optimistic about 2023 with plenty of opportunities to expand portfolios by acquiring decent investments at low valuations — the UK market being highlighted as a “bargain basement”.

If your circumstances allow it, investing any surplus funds in undervalued investments could see you benefit significantly in the long term.

3. While the UK is expecting a two-year recession, long-term projections are positive and inflation is believed to have finally peaked

According to the BBC, the IMF projects that the UK is expected to be the only major economy to enter a recession, which is expected to last until the end of 2024.

However, there are plenty of reasons to be positive about UK financial news and it is important to remember the economy and the stock market aren’t the same.

Read more: Why the stock market is not the economy

High inflation has been a major issue for millions of Brits in recent times and sparked a cost of living crisis as the cost of goods and services year on year shot up significantly.

But, inflation is believed to have peaked now and according to the Bank of England (BoE) is expected to come down over the coming year.

According to the Guardian, the UK’s leading stock market index — the FTSE 100 — closed at a record high in February 2023, and it is likely to see further growth in 2023.

The short-term outlook for UK investors may still seem volatile, but over the long term it is looking like the worst is now behind us.

4. Markets typically bounce back over the long term and risks reduce over time

While markets can see sharp downturns, especially during volatile economic periods, over the long term they typically bounce back and see growth.

If you are impatient or allow short-term worries to influence your investing decisions, you may convert what is initially a paper loss into a definite one, and lose the possibility of seeing your investment rebound.

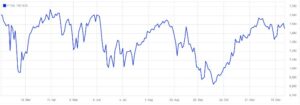

For example, if you look at the performance of the FTSE 100 over 2022 it ebbs and flows considerably, as shown by the graph below:

Source: London Stock Exchange

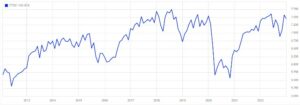

However, if you pull back and take a look at the bigger picture over a 10-year period, you can see that the market typically follows an upwards trajectory and tends to recover from short-term falls, such as that seen by the onset of the pandemic in March 2020.

Source: London Stock Exchange

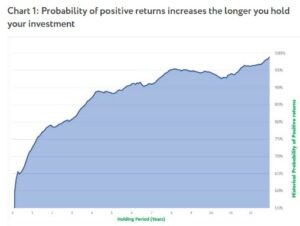

According to Nutmeg, the probability of seeing positive returns from your investments increases over time as shown by the graph below:

Source: Nutmeg

Working with a financial planner can see you overcome any short-term worries and stay on track towards your long-term goals.

Get in touch

If you have any lingering concerns about your portfolio and are worried about the year ahead, you should email us at mail@delaunaywealth.com or call us on 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Investments carry risk. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production