Morningstar’s global chief investment officer, Dan Kemp, recently said: “The stock market is not the economy”. A bold statement, but what exactly does it mean?

The two aren’t intrinsically linked. It is a mistake many misinformed investors tend to make during periods of economic downturn that can lead to emotionally compromised decisions for their investments.

So, what are the key differences between stock markets and the economy and how do they perform differently at times? And how can improving your understanding of their relationship benefit your investment choices?

Read on to discover the relationship between stock markets and the greater economy and how knowledge can help mitigate the potentially negative effects of emotionally charged financial decision-making.

The economy relates to goods and services, while the stock market is made up of companies and other securities

A nation’s economy is an overview of its production and consumption of goods and services. It can use factors such as employment rates or the Gross Domestic Product (GDP) to measure its economic health.

Meanwhile, the stock market is a collection of indices in which investors are able to buy and sell shares in listed companies and other securities.

It can be easy to confuse the two. But it’s important to note that:

- Stock performance doesn’t represent everyone that participates in the greater economy

- Indices are disproportionately made up of large corporations, while many unlisted small businesses can be major drivers within an economy

- Stock market prices reflect investor confidence in the future, while economic indicators view spending and employment factors in the recent past and present.

While it is possible for the economy and stock markets to move in sync at times, that isn’t always the case, and it would be a mistake to always assume if markets are up that the economy is doing better.

After over a year of rising inflation, the UK economy has entered a recession

After the chaos of the short-lived Truss regime and their “mini-Budget”, a new prime minister and chancellor have taken charge and reversed many of their predecessors’ policies in the recent autumn statement.

Read more: After months of political unrest and budget reversals — what has actually changed?

The turbulence caused by these recent events only added to the misinformed conclusion held by some that the economy and the stock market are inherently the same thing.

The UK economy has entered a recession after over a year of rising inflation contributed to the worst cost of living crisis experienced in decades.

According to the Office for National Statistics (ONS), inflation in the UK sits at 10.7% for the year to December 2022. But recent developments, such as the Bank of England (BoE) increasing the base rate to 3.5% (15 November 2022), are expected to slowly bring it under control and reduce it to manageable levels within the next two years.

inews reports that the Office for Budget Responsibility (OBR) forecasts the UK will not emerge from the recession until 2024.

Read more: 6 ways to navigate the impending recession

Conversely, while stock markets have ebbed and flowed over the course of 2022, in the UK, the FTSE 100 is projected to continue an upward trajectory of long-term recovery from the dip that occurred during the onset of the global pandemic. For example, JP Morgan reports that the FTSE All-Share rose 7.1% in November 2022 alone.

Stocks have been rocky in the short term, but the bigger picture shows they are performing well

2022 has been a volatile year for stock markets as macroeconomic factors such as the global energy crisis, pandemic, and war in Ukraine have caused issues for businesses around the world.

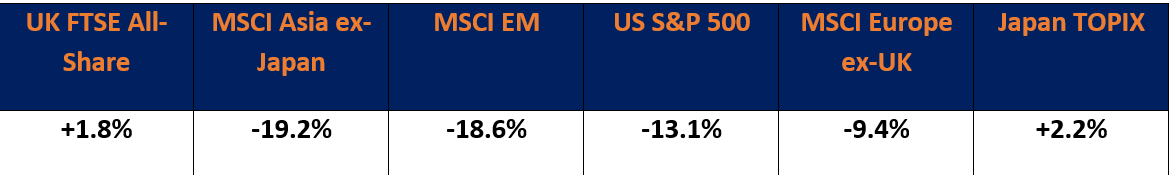

The table below shows the performance of some of the world’s leading stock indices in the year to the end of November 2022.

Source: JP Morgan

It is evident that stock markets can be particularly unstable during periods of high inflation and rising interest rates. Nevertheless, we can see from the data that the UK’s leading stock market index has seen positive returns for the year so far, while the economy as a whole is in decline.

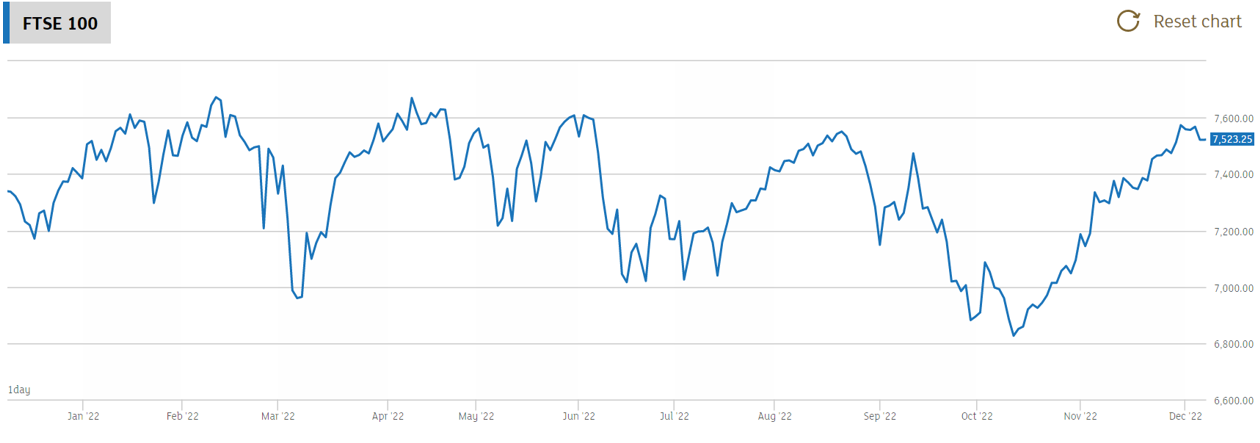

The graph below shows the peaks and troughs of the UK’s FTSE 100 over the past year.

Source: London Stock Exchange

While the UK economy has been gradually slowing down as inflation has continually risen, the FTSE 100 has ebbed and flowed over the course of the year.

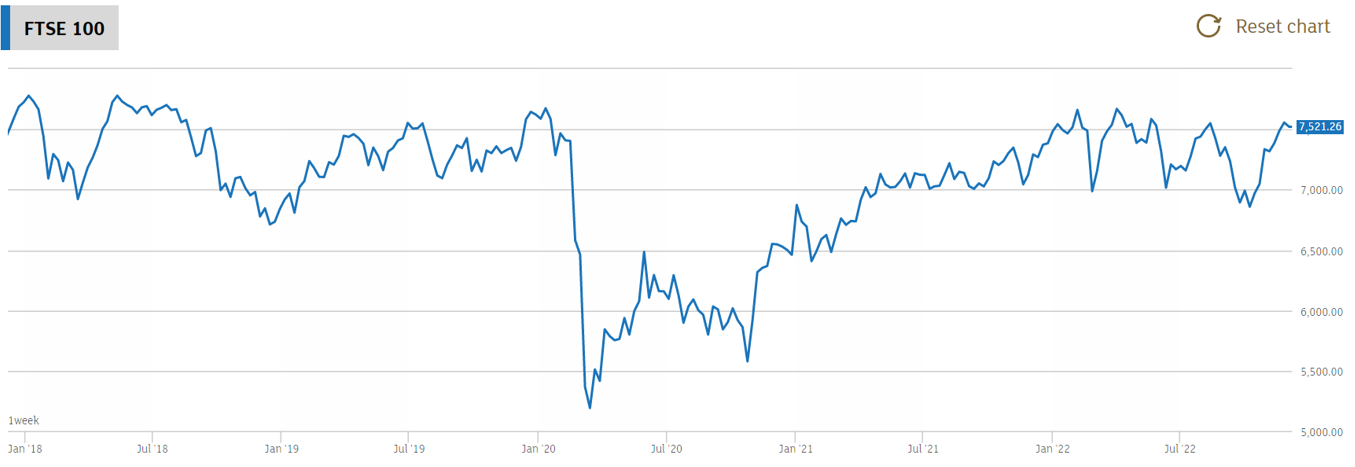

It can seem worryingly volatile when we look at those short-term trends. But if we look at the bigger picture and zoom out to reflect on its performance over the past five years:

Source: London Stock Exchange

It becomes apparent that after a sharp dip at the onset of the pandemic, the FTSE 100 has largely been on an upwards trajectory over the past two years and is nearly back at pre-pandemic levels.

Many of the companies listed on the FTSE 100 – while being domiciled in the UK, listed on the London Stock Exchange, and priced in sterling – are multinational firms that do the majority of their business overseas and are largely unaffected by local issues within the UK economy.

Investing is best viewed as a long-term strategy. IG reports that the median annual return for the FTSE 100 for any 10-year period between 1984 and 2019 was 8.43% with dividends reinvested. Don’t allow news about an economic downturn in the present affect your long-term approach to stock markets.

Approach your investments with a calm mind

It is easy to become spooked by the negative news cycle and worry about the possibility of losses.

The theory of “loss aversion” posits that humans feel the pain of losses twice as strongly as the pleasure of gains.

This can create a fear response and result in emotional decisions driven by psychological bias, which can hinder your progress towards your long-term goals.

For example, selling shares in a declining marketplace means you essentially lock in a loss, removing the potential for an upturn in value as and when the market eventually recovers.

Working with a financial planner can be especially beneficial here. We can act as a sounding board to reassure you and help avoid choices you may later regret.

It is important to note that an International Longevity Centre study found that individuals who sought professional financial advice between 2001 and 2006 had, on average, £47,706 more wealth by 2014/16 than those who had not taken advice.

Get in touch

A financial planner will likely advise you to build a well-diversified portfolio aligned with your tolerance for risk that will be better insulated against short-term volatility, as it can be a mistake to “put all your eggs in one basket”.

If you have any further queries about how you may be affected by the economic downturn and if it means anything for your investments, it is important that you seek professional advice.

Please contact us at mail@delaunaywealth.com or call us on 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production