If you’re dreaming of stepping away from the world of work to enjoy a long and joyful retirement, you’re not alone.

The coronavirus pandemic triggered a huge upsurge in the number of people retiring in the UK and, according to the Office for National Statistics, 50- to 64-year-olds represent the largest group to have become economically inactive.

However, Canada Life has warned of a “new retirement gap” as many people underestimate their life expectancy, leaving themselves with too little in their pension pot to cover later life.

If you’re worried about having enough savings to fund the retirement you want, a few simple lifestyle changes and the help of a financial planner could help you make a realistic plan for a long and happy retirement.

5 top tips for a longer, healthier life

Whatever age you choose to leave work, being in good health will allow you to enjoy your retirement to the fullest.

There are many ways to stay fit physically and mentally, both now and in your later years. Choosing those that suit your lifestyle and bring you joy will make new routines easier to stick to.

1. Do some physical activity every day

The National Health Service (NHS) recommends that adults aged 19 to 64 should aim to do between 75 and 150 minutes of exercise per week, depending on the intensity, spread over four to five days.

If the thought of running in public or leaping around in an exercise class fills you with dread, don’t despair.

Recent research reported by the British Heart Foundation found that a lifetime of regular brisk walking could make “you look and feel 16 years younger by middle age”.

2. Eat mindfully

Eating well isn’t just about what you eat but also when and how you eat.

Regular meals and mindful eating will help to keep your digestive system healthy. So, if your work routine changes or ends, try to keep to a similar routine of meals.

Avoid eating on the go and take your time over meals. By eating mindfully you’re more likely to notice when you feel full and avoid overeating, which will help you to maintain a healthy weight. You’ll also minimise the stress that can trigger digestive problems.

3. Develop a healthy sleep routine

Research published by the Guardian suggests that people who regularly sleep well can add years to their lives.

Try to go to bed at a similar time each night and allow yourself around eight hours of sleep. If you struggle to drop off, do something relaxing such as listening to calming music or reading a book before trying again to sleep.

Create a dark, cool, and relaxing sleeping environment by switching off electronic devices, using room-darkening curtains or blinds and blocking out external noise with earplugs.

Meeting your recommended quota of daily activity will also help you to sleep well.

4. Stay socially active

According to a report by AgeUK, social interaction can boost brain health in later life.

Your workplace may form a big part of your social life. When you retire, it’s important to build new social networks, perhaps by joining clubs and groups, to stay sharp and maintain your wellbeing.

In today’s digital world, it’s easy to keep in touch with friends, family and former colleagues as well as making new connections.

5. Reduce stress

Excessive stress over a prolonged period can take a toll on your physical and mental health. You might feel stressed for any number of reasons, but financial concerns often top the list.

Recent research published in the Independent suggests that money worries could be linked with an increase in some mental health conditions. So, getting your finances in order could help reduce stress and promote better health.

Planning for your retirement will help you to have realistic expectations about how much you’ll have to live on.

You might also be able to identify opportunities for maximising your savings, such as tracking down old pensions or boosting your contributions.

Understanding your financial needs in retirement is key to providing adequately for your financial future.

The importance of life expectancy in your retirement planning

Taking life expectancy into account is an important part of retirement planning as you need to ensure your pension savings last you for your entire life – however long that might be.

Yet many people underestimate how long their pension fund will need to last them.

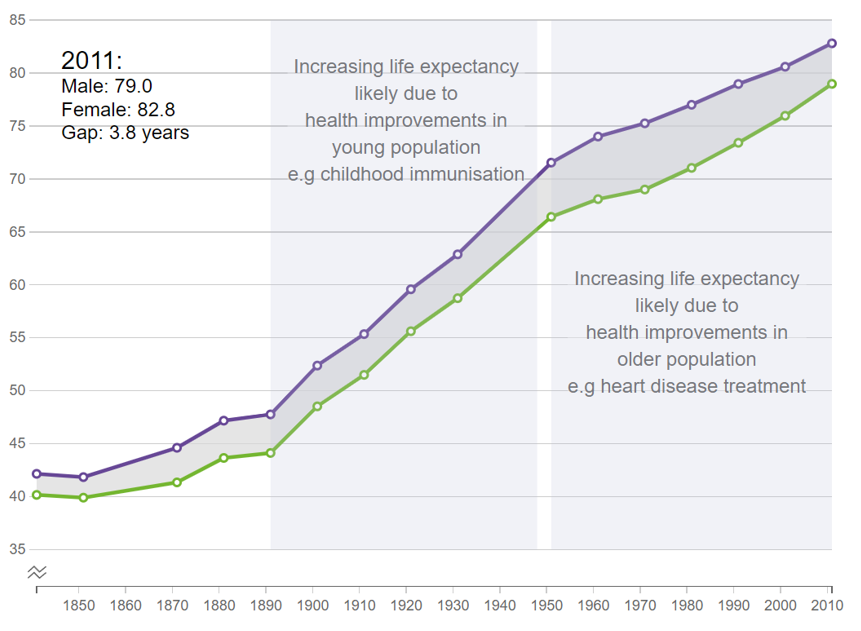

Life expectancy has changed significantly over time. As the below chart from the Office for National Statistics (ONS) shows, the male life expectancy leapt from 68 years in 1961 to 79 years in 2001, and female life expectancy rose from 74 years to 83 years in the same 50-year period. And the ONS forecasts life expectancy will continue to rise.

Source: Office for National Statistics

When planning for your future, make sure that you have a realistic expectation about how many years you will need to finance.

Underestimating your life expectancy could see you deplete your savings too soon, meaning you run out of money in later life, or you have to make compromises to your lifestyle.

One of the ways that we can help you to ensure you have “enough” is to use sophisticated cashflow modelling. We can look at your income and assets, factor in assumptions about your life expectancy, and determine whether you can live the lifestyle you want. If not, we can also help you to get on track to get there.

Get in touch

If you are keen to start planning for your retirement and want to gain a greater understanding of how a financial planner can help, we’d love to hear from you.

Please email us at mail@delaunaywealth.com or call 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate cashflow planning.

Production

Production