Financial planning is all about helping your clients develop a road map for their lives. A thorough plan is designed to support their:

- Personal circumstances

- Major milestones

- Tolerance for risk

- Long-term goals.

Working with a knowledgeable and trustworthy financial planner could help give your clients peace of mind that they are financially prepared to cope with all of life’s changes, and challenges.

However, poor advice or working with a financial planner who doesn’t put your clients’ interests before their own could negatively affect your clients’ emotional and financial wellbeing.

This may be even more important than you think, especially considering recent research from the Financial Conduct Authority (FCA). FTAdviser reports that the FCA found that fewer than half of UK adults have confidence in the financial service industry.

So, with that in mind, what qualities should your clients look for when thinking about working with a financial planner? Read on for three important factors that probably matter most.

1. Financial knowledge and expertise

Perhaps the most obvious quality your clients will look for in their financial planner is wide-ranging and comprehensive knowledge and expertise.

They’ll want to be confident that the person who is guiding their decisions and long-term financial plans is qualified to do so and well-versed in the range of issues your clients may face.

At Delaunay Wealth, we have an incredibly talented core team who provide a diversified set of skills.

Lloyd has 25 years of experience as a financial planner. Voted one of VouchedFor’s Top Rated Advisers in 2021, 2022, and 2023, he provides expert, fully audited, holistic advice on:

- Pensions

- Savings

- Protection

- Estate planning

- Tax-efficient investments.

He also has a wealth of professional qualifications, including a:

- Certificate in Life and Pensions

- Certificate in Mortgage Advice

- Diploma in Financial Planning

- Financial Planning Certificate.

Your clients can find out more about Lloyd’s experience, his background, and what he enjoys in his free time on our website.

Working with Delauney Wealth and with Lloyd by their side, your clients can rest assured that any advice given is coming from someone with vast experience, knowledge, and expertise.

2. Honesty and transparency

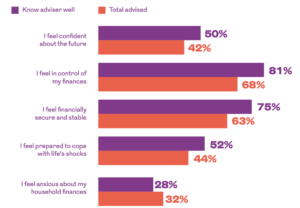

When Royal London undertook a study into the financial and emotional wellbeing benefits of receiving financial advice, they found that advised individuals typically reported better outcomes than those who hadn’t received any advice.

The reported benefits of receiving advice were even greater for those who had developed trusting, ongoing relationships with their advisers, as shown by the chart below:

Source: Royal London

One survey participant said: “The most important benefit for me is the fact that my financial adviser is a trustworthy person with excellent feedback from other clients”.

Honesty, transparency, and trust between clients and their financial planner could help alleviate doubts about any advice given and help reassure your clients that the people guiding them are acting in their best interests.

At Delaunay Wealth, we strive to foster trusting, healthy relationships with all our clients. This is done from the first meeting and throughout every stage of our clients’ personal journey.

Read more: Why the first financial planning meeting is so important — here’s what your clients should expect

We’re also proud to say we’re officially a VouchedFor Top Rated firm, with clients giving us an average score of 4.9 out of 5 across more than 70 reviews.

The benefits to your clients of having a healthy relationship with their financial planner shouldn’t be underestimated.

Beyond any emotional peace of mind, Royal London’s findings also revealed that those who had a long-term relationship with their adviser were on average 50% financially better off than those who hadn’t sought advice or had only received it once.

3. Good communication skills

One of the major issues outlined in FCA’s study was the difficulty many Brits experienced in getting hold of their advisers and receiving the information or support they required.

Your clients’ financial journey will likely take years or decades and will incorporate different life stages and major milestones. It is important that from their first meeting to their last, they continue to receive quality advice, delivered in a prompt, regular, and reliable manner.

Your clients should be able to reach out at any time to check in on the status of their financial plans, discuss changes they want to make, and receive advice on any issues that arise.

At Delauney Wealth, communication is baked into every stage of your clients’ journey – we keep in regular contact with every client through emails, phone calls, monthly newsletters, and ongoing meetings and reviews.

We get to know our clients

We want to understand their personal stories, backgrounds, life goals, and worries. It all helps us deliver the best possible service and allows us to guide them along a path to their long-term objectives.

In a time when so many are worried about financial issues arising from the cost of living crisis and increasing interest rates, having a financial planner to turn to could provide significant reassurance – especially for the most vulnerable.

Read more: 4 genuine signs your clients might be vulnerable and how to help

Ultimately, to find the right financial planner, your clients need to ensure that the person they choose to work with is a good fit. That’s why we offer a free initial consultation to every prospective new client.

If your clients would like to set up an initial meeting, they should email mail@delaunaywealth.com or call 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production