If you weren’t familiar with inflation a few years ago, you probably are now, with the ongoing issue a regular feature in news stories amid the cost of living crisis.

Inflation refers to an increase in the general price level of goods and services, which can correspondingly erode the “real” value of cash over time as its purchasing power declines.

The UK has endured a lengthy period of high inflation caused by a wide range of issues, including the pandemic, war in Ukraine, the energy crisis, and Brexit.

So, what exactly does long-term high inflation do to your wealth? Here’s what you need to know and three useful steps you could take to protect the value of your money.

Long-term high inflation could cost savers thousands

Standard Life recently conducted a study into the long-term effects of inflation on savings.

They found that an individual’s purchasing power could significantly decline if their savings were exposed to high levels of inflation for a sustained period of time.

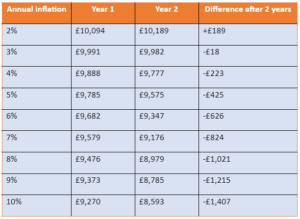

After two years, £10,000 in cash savings earning 3% interest could see the following effects on its real value based on different levels of inflation, as shown by the table below:

Source: Standard Life

It is evident that long-term exposure to inflation of 8% or higher could see the real value of your savings diminish by thousands of pounds – UK inflation is at 8.7% in the year to May 2023.

The Office for National Statistics (ONS) has reported double-digit inflation figures in 8 out of the past 12 months.

While forecasts predict a gradual decline in inflation figures throughout 2023 and into 2024, inflation figures are likely to remain above the 2% BoE target for the foreseeable future.

It is not surprising then that research from Canada Life reports that 83% of advisers in the UK cite inflation as the number one concern for their clients.

If you are worried about inflation and interested in steps you could take to protect the value of your money, you might want to consider the following.

3 useful ways to protect the value of your money from high inflation

1. Make sure you have the best savings rates possible

Firstly, it’s important that you ensure that any money retained in a savings account is benefiting from the best interest rates possible.

So, consider taking the time to review your options before you take any additional steps with your funds. Moneyfacts reports the best rates across different types of savings accounts on a daily basis.

An alternative savings option to a regular savings account is a Cash ISA. They often come with decent account rates, which can help limit the eroding effect of inflation on your savings.

Read more: The essential guide to ISAs

2. Consider increasing your pension contributions to protect your retirement income

Your workplace and private pension pots are likely to form the backbone of your retirement plans. So, using surplus funds to increase your pension contributions could have the dual benefit of protecting your wealth from inflation, while helping you to prepare for your future.

Pension schemes can be incredibly tax-efficient, with tax relief on contributions at the basic-rate of Income Tax up to the Annual Allowance of £60,000 (2023/24 tax year), or 100% of your earnings, if lower. Higher- and additional-rate taxpayers can claim further relief through their self-assessment returns.

Over time, pension pots have the potential to grow substantially thanks to the effects of compound returns. In effect, returns gained on your pension investments are added to your pot and used to invest further, creating a cycle of, hopefully, ever-increasing returns.

Penfold reports that the average annual returns on pension funds over the past 40 years is 7%, which is better than the best current rates on savings accounts and Cash ISAs (as of 3 July 2023).

3. Think about investing your surplus funds in stocks and shares

While markets can ebb and flow, and past performance is no guarantee of future success, a look at historical data shows that investment returns typically outperform cash savings.

According to research from Schroders, annual equity returns had a 91% probability of outperforming cash savings over any 10-year period between 1900 and 2023. Even when viewed over a shorter window of two years, equity returns had a 70% probability of outperforming cash savings.

Stocks and Shares ISAs could be a smart way to invest your funds, while benefiting from associated tax-efficient benefits, such as being exempt from Capital Gains Tax and Income Tax.

The Motley Fool reports that average Stocks and Shares ISA returns over the past 10 years have been 9.6%.

It is possible that opting to invest your funds could protect them from the worst effects of high inflation.

Don’t forget to set aside an emergency fund

Savings are an essential part of any financial plan. They offer a safety net in the event of an emergency or funds to cover essential bills.

So, before you opt to spend or invest your cash, it’s a good idea to set up a savings account specifically for essential outgoings, such as rent, bills, or groceries.

Get in touch

If you have any lingering concerns about inflation and its effect on your hard-earned savings, you should consider reaching out for expert advice to determine the best next steps.

Please email mail@delaunaywealth.com or call 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production