A quick glance at current news headlines can naturally be a little bit concerning. High inflation, rising interest rates, and market instability, all play a part in the current cost of living crisis and have the potential to affect your finances.

But as the author Douglas Adams once famously said: “Don’t panic!”.

Your current financial plan will have been devised with a whole range of financial unknowns and variables factored into it. This will include periods of increased investment risk, inflation, and changes to your current circumstances.

If your long-term goals haven’t changed in the last six months, then it’s unlikely that your plan will need major alterations either. Simple adjustments and seeking the right advice can help to alleviate any fears.

Remember: Keep calm and don’t make any knee-jerk decisions.

Read on for further insights into three current events, how they might be affecting you and what you can do about them.

1. There is high inflation in the UK presently, which can erode the real value of your savings

As of the start of June 2022, the Office for National Statistics (ONS) reports that annual UK inflation is at 9.1%. In practical terms, this means that £100 worth of goods and services a year ago would cost you £109.10 if purchased today.

Global events have had a domino effect that has led to rising inflation.

The Bank of England (BoE) reports that supply chain and workforce issues, caused by the pandemic, has impacted numerous key sectors within the economy. Furthermore, the war in the Ukraine has disrupted supply further and has directly led to a global energy crisis, which has seen energy bills and fuel costs increase by double-digit percentages.

While interest rates are also on the rise, current rates on savings accounts still sit far below the rate of inflation. According to Money-facts, as of 15 July the best rate for an easy access account is just 1.5%. It is 2.7% for a one-year fixed-rate bond.

Leaving money in cash savings means that, at present, it won’t be keeping pace with the rising cost of living. So, it will likely be losing its value in real terms.

The first step in reviewing your financial plan should be researching if you have the best possible interest rate on your savings account currently and whether it would be worthwhile moving accounts.

Once you’ve made this decision and ensured that you have an emergency fund set aside of at least three months’ worth of essential bills, then you should consider if it would be more beneficial to invest your surplus cash elsewhere.

If you are investing for the long term (typically a minimum of five years), then investing your spare cash could provide the potential for better returns.

Of course, the value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

2. Being proactive with your debt in the face of rising interest rates can save you money in the long term

Rising interest rates can affect your mortgage payments or other loans. In June 2022, the BoE raised the base rate for the fourth time this year to 1.25% and there will likely be further rises later this year and beyond.

If your mortgage is on a variable rate, standard variable rate (SVR), or tracker-based interest rate then it might be beneficial to assess a few key options.

If you have a tracker-rate mortgage, then your repayments will likely have risen several times since December 2021.

According to the Guardian, an interest rate rise from 2.25% to 2.5% adds £18 a month to a £150,000 tracker-rate mortgage arranged over 20 years.

While interest rates are on the rise, they are still historically low. So, if you don’t have any early repayment charges for repaying your current mortgage, or you’re on your lender’s SVR, there’s still plenty of opportunity for you to take advantage of low rates on your mortgage or other borrowing.

3. Seeking financial advice during a period of market instability can help you protect your investments

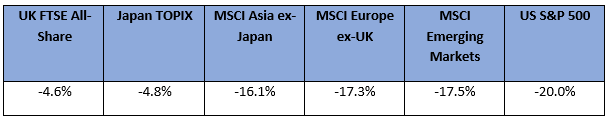

2022 has been a tough year for stock markets around the world. The table below shows the performance of some of the world’s leading stock indices in the year to the end of June 2022.

Source: JP Morgan

It is evident that stock markets can be especially volatile during periods of high inflation and rising interest rates. Nevertheless, it can be counterintuitive to sit on your savings in the hopes that playing it safe will generate a more positive return.

As previously mentioned, the real value of your savings will likely decline during periods of high inflation. Conversely, the median annual return for the FTSE 100 for any 10-year period between 1984 and 2019 (as reported by IG) was 8.43% with dividends reinvested.

Working with a financial planner to build a well-diversified portfolio aligned with your tolerance for risk can help you to reach your financial goals.

Get in touch

If your savings goals haven’t changed, then it’s unlikely you’ll need to alter your financial plan.

If you have concerns, then seek the reassurance needed to alleviate your worries by reaching out to us. It’s important to remain calm, keep focused, and if for any reason you’re not on track, then take steps with your planner to ensure your goals remain attainable.

Email mail@delaunaywealth.com or call us on 0345 505 3500.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production