The Financial Conduct Authority (FCA)’s Consumer Duty came into effect at the end of July 2023. These new regulations aim to hold advisers and firms across the UK’s financial sector accountable to a higher standard of service.

It is increasingly important for advisers and planners to take additional steps to ensure their clients are protected, and that the financial advice they receive:

- Serves their best interests

- Takes into account their personal circumstances

- Correctly assesses their tolerance for risk and vulnerability.

It is hoped the FCA’s guidelines will stop unscrupulous advisers taking advantage of vulnerable individuals and promote better financial advice.

Here’s what the Consumer Duty entails, four key signs of vulnerability you should be aware of, and how you can help your clients if you think they need professional guidance.

The Consumer Duty seeks to ensure that clients receive good outcomes

UK Finance cites that the FCA’s Consumer Duty has been described as “one of the biggest shake-ups to retail financial services regulation”.

The Consumer Duty details a set of consumer protections that require firms and advisers to act in a more ethical manner. The new guidelines put an emphasis on working towards delivering positive outcomes for clients.

There are four overarching areas that the Consumer Duty focuses on within the adviser/client relationship. These relate to positive outcomes for clients within:

- Products and services

- Price and value

- Consumer understanding

- Consumer support.

The Consumer Duty’s rules require advisers and firms to:

- Put client outcomes before their own profits

- Act in good faith

- Avoid causing foreseeable harm

- Enable and support retail clients in pursuit of their financial objectives.

In order to adhere to the regulations, businesses will need to be able to produce evidence to support their assertion they are working in their clients’ best interests.

The Consumer Duty identifies 4 key characteristics to help identify vulnerable clients

According to FTAdviser, the Consumer Duty emphasises that firms and advisers must act to deliver good outcomes for their clients, especially those in vulnerable circumstances.

Vulnerable individuals include those who are more susceptible to experiencing periods of adversity, which in turn could affect their finances and their financial decisions.

Identifying and supporting these individuals has become increasingly important in recent years due to the cost of living crisis and pandemic.

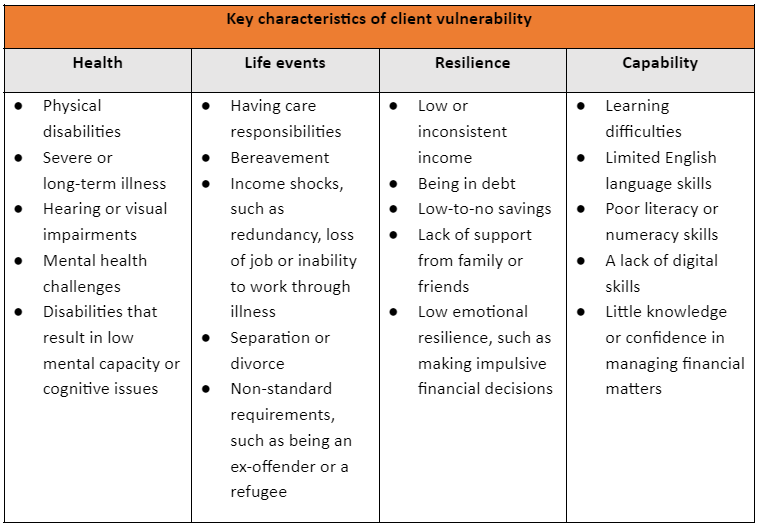

Royal London outlines the key characteristics of vulnerability as outlined by the FCA, as shown in the table below:

Source: Royal London

Your clients’ potential vulnerability may not be clear at first glance, but many of them may be exposed, as Royal London’s data shows. Their findings determined that:

- 47% of UK adults show one or more characteristics of vulnerability

- 24% of UK adults have low financial resilience

- 60% of UK adults reported keeping up with their domestic bills and debt commitments as being a “heavy” or “somewhat heavy” burden.

A possible first step towards helping your vulnerable clients is to keep up a healthy level of communication.

Developing an ongoing relationship with them and helping them feel safe might encourage them to discuss their issues with you. This will likely help you identify any potential problems ahead of time.

How to help your clients if they are showing signs of struggling with their health, life, resilience, and capability

If your clients are displaying signs of any of the four key characteristics of vulnerability, it is important that they are receiving the right kind of help with their issues.

If you are concerned about the financial advice they are receiving, there are ways to check if their adviser is adhering to best practices. This could involve reviewing whether they are following through with the guidelines established by the Consumer Duty.

At Delaunay Wealth, we work towards offering our clients an honest and transparent service that puts their best interests front and centre.

We ensure our clients continually receive high-quality advice by having checks and balances across every step of their financial journey with us.

Read more: 4 important ways we tailor our approach to our clients’ needs

Our award-winning website – winner of the 2023 Professional Adviser Best Adviser Website Award – details our process, core values, and the key stages of your clients’ financial journey with us.

We also actively encourage reviews from our clients and are proud to say we are one of VouchedFor’s Top Rated Firms in 2023 with a rating of 4.9 out of 5 from more than 70 reviews.

Our financial coaching toolkit utilises:

- A diverse team with a wealth of skills and knowledge

- Cashflow modelling to inform any recommendations for your clients’ plans

- A simple, jargon-free approach to advice

- Ongoing meetings and communication

- Integrated and easy-to-use technology.

If you believe your clients could benefit from speaking to someone with high professional standards and who will actively work in their best interests, they might want to reach out to us.

Get in touch

We don’t want to rush into any relationship. It is important that the advice your clients receive suits their personal circumstances, especially if they show signs of potential vulnerability.

Our onboarding process aims to understand your clients’ background and present situation, identify any risks, and ensure that every step of their journey is undertaken with their best interests in mind.

To set up a meeting, they should email us at mail@delaunaywealth.com or call 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production