The American author and relationship counsellor, John Gray, wrote in his 1992 novel of the same name: “men are from Mars, women are from Venus”. It has since become a common expression to demonstrate the differences between the genders.

It has also spawned a wide range of rebuttals from social scientists, who have argued that men and women aren’t that different at all. In fact, we share many of the same needs, desires, and goals.

However, one area in which differences between the two has remained stark is financial outcomes.

You’ll probably have heard about the gender pay gap, in which men are typically paid more than women for equivalent jobs or comparable levels of work. According to figures from the Office for National Statistics (ONS), the gap in the UK in 2022 was 8.3% for those in full-time employment.

But you might not have heard about the differences between men and women across a wide range of other financial issues.

Here are three you may want to be aware of.

1. Men are likely to have larger pension pots than women

Your pension is likely to be a key part of your retirement plans. So, it might be worrying to discover, especially if you’re a woman, that there is a considerable difference in pension outcomes between the genders.

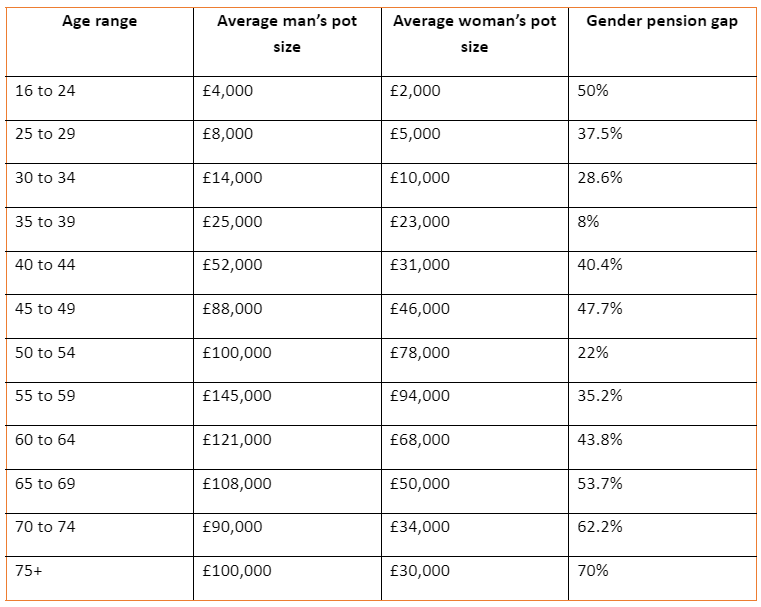

Department of Work and Pensions (DWP) data released in June 2023 found an average pension wealth gap of 35% between men and women for the years 2018 to 2020.

There was a noticeable gap across all age ranges, but especially among the youngest and oldest men and women, as shown by the table below:

Source: interactive investor

The DWP’s release comes as the Actuarial Post reveals that 73% of women only make the minimum pension contributions, compared to 58% of men. It is likely that the gender pay gap has contributed to the gap in pension wealth as well.

If you are a woman approaching retirement age, it might be worth sitting down with an adviser to review your pension plans and see if there might be ways to boost your savings.

2. Women are more anxious about investing than men

Investing comes with its associated set of risks. Yet, it can be an incredibly useful way of generating growth on your wealth.

However, despite the potential benefits, many women opt against investing their savings.

According to research reported by MoneyWeek, women report greater levels of worry and anxiety than men when it comes to investing. The study showed that 74% of British women were anxious about investing compared to only 58% of men.

It also found that:

- 61% of women said they have definite future savings goals, compared to 49% of men

- In 2022, the UK gender investment gap was approximately £600 billion due partially to millions more men investing than women

- The gap exists across all age groups, with 28% of men aged between 18 and 35 investing compared to just 14% of women, while 47% of men aged 65 and over invest, compared to only 28% of women.

The research also discovered that women prefer to keep their money in a cash savings account rather than invest.

While saving a portion of your funds in cash is likely to be prudent, in the face of high UK inflation over the past year, considering the benefits of investing could be key to preserving the buying power of your wealth.

Read more: How to protect your money as long-term high inflation affects UK savers

If you are unsure about investing or don’t know where to start, it might be worth sitting down for a meeting with an adviser to discuss your options and potentially find a solution that suits your personal circumstances.

3. Men are more likely to benefit from financial advice than women

According to a 2022 study from Canada Life, men are more likely to seek out professional financial advice than women. In contrast, women are more likely to seek input from family and friends.

Professional financial advice can be incredibly beneficial when trying to reach financial goals. It can also provide a welcome boost to your emotional wellbeing.

These benefits could be even greater for women than men considering women are more likely to have less income to live on while being more likely to live longer, given average life expectancies.

Research from Royal London details the financial and emotional wellbeing benefits of receiving financial advice.

Advised individuals reported better outcomes than non-advised, as shown by the graphic below:

Advised individuals – especially those who had long-term, ongoing relationships with their advisers – also reported better financial outcomes, being up to 50% better off than individuals who sought out advice only once.

If you have any ongoing concerns about your long-term financial plans, a meeting with a financial adviser could go a long way towards assuaging those worries, while helping you plan out how to reach your goals.

Get in touch

Financial issues can be stressful for both men and women. Working out a solid financial plan that accounts for your personal circumstances and goals, might provide you with some welcome relief.

To discuss how advice might help you or to revisit your existing plans, please email mail@delaunaywealth.com or call 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production