The last few years have resembled a chain of falling dominos, as one problem in the news cycle led into the next — the pandemic, the war in Ukraine, the cost of living and global energy crises — at times it may have felt relentless.

It is important to stay calm though, as you can often overcome obstacles with well-informed solutions.

The latest challenge facing millions of Brits is rapidly rising interest rates.

In a bid to stop climbing inflation — which peaked at 11.1% in the year to October 2022 and has come down slightly since — the Bank of England (BoE) has increased the base rate 10 times since March 2020 with the rate, as of 2 February 2023, sitting at 4%.

Subsequently, lenders are raising their respective interest rates in response.

But what does that mean for you and how might you navigate them? Read on to discover three important reasons financial planning may be the solution.

1. Financial planning can encourage you to maximise the efficiency of your savings

According to Capital.com, the bank rate is projected to reach 5.2% in the fourth quarter of 2023, which is likely to push borrowing rates even higher.

So, as interest rates rise, it might be worth reviewing your savings situation and determining the most efficient way to protect and grow your funds.

The Guardian reports that British savers have a collective £268 billion languishing in accounts paying no interest. A move to a savings account with the best possible rates could help protect your wealth over the long term.

Read more: Nearly £1 trillion is languishing in easy access accounts paying an average interest rate of 0.18%

Although, you should note that inflation is still at a historically high level and is currently outpacing interest rates.

Working alongside a financial planner can help you figure out the right approach towards your savings in the short and long term, and source the best possible deals.

Moneyfacts tracks the best available savings rates on a daily basis — 4.17% on one-year fixed-rate accounts as of 14 February 2023.

Rates are even better with ISAs — 4.25% for a fixed rate as of 14 February 2023 — and there are additional tax relief benefits such as any interest produced on your savings being tax-free.

Remember: whatever you decide, it is important to establish an emergency savings fund — especially during volatile times — of ideally at least three to six months’ worth of essential bills to protect you should the worst occur.

2. Financial planning can help you get the best deals for your debt obligations

Credit options can provide welcome relief during troubling times, but as interest rates rise, so does the cost of borrowing.

Reviewing mortgage agreements has likely been a priority for many individuals and businesses over the last few months — especially if they are on a variable- or tracker-rate mortgage.

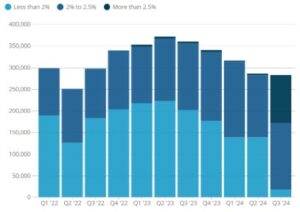

According to a report by the Office for National Statistics (ONS), 45% of adults with mortgages said they were “very” or “somewhat” worried about ongoing changes in mortgage rates. More than 1.4 million households could be affected in 2023 as their existing fixed-rate mortgages mature, with 57% of them having been previously fixed at rates below 2%, as shown by the graph below:

Source: ONS

For example, if you had an existing 2% fixed-rate £300,000 mortgage mature and saw its interest rate increase to 6% — which could have happened when rates peaked in the autumn — assuming a 25-year capital and repayment mortgage, the monthly payments on the same mortgage would increase by £661.

Working alongside a financial planner, you can take valuable steps towards softening any rises in your debt obligations and ensuring your plans are still on track towards your long-term goals.

A financial planner can help in various ways, such as:

- Searching for the best possible mortgage products for your circumstances

- Advising you on the pros and cons of a fixed-, tracker-, or variable-rate agreement and whether they suit your plans

- Reviewing if opting to make early repayments could be beneficial in the long term.

You may be hit with charges if you opt to make early repayments, so you’ll need to factor this in.

There is hope on the horizon, as according to This is Money, a competitive market for lenders and a prediction that UK inflation has peaked has recently seen five-year fixed-rate deals drop below 4%.

3. Financial planning can keep you focused on the future and generate growth on your surplus savings

While interest rates are on the rise, they are still being outpaced by current UK inflation, which according to the ONS is 10.1% as of 15 February 2023. This can have an eroding effect on the “real value” of your savings, as the buying power of your money diminishes as the cost of goods and services rises.

Read more: 3 current events that could affect your financial plan – and what you can do

So, once you’ve secured your savings and reviewed your debts, it might be worth considering investing surplus funds to generate the growth needed to reach your long-term goals.

Rising interest rates could lead to beneficial investing options. As American investor, Warren Buffett, detailed when he said: “The value of any economic asset is 100% sensitive to interest rates. The higher interest rates are, the less that present value is going to be. Every business, whether it’s Coca-Cola or Gillette or Wells Fargo — its intrinsic valuation is 100% sensitive to interest rates”.

When traditionally high-value companies are priced lower than expected, you may be able to invest with a cheaper outlay, and potentially see positive returns in the long term if and when markets bounce back.

Working with a financial planner can ensure your portfolio takes advantage of any short-term opportunities, and is protected from any sharp fluctuations through diversification and patient oversight.

Get in touch

If you have any concerns about rising interest rates and what they might mean for your financial circumstances, it might be worth getting in touch at mail@delaunaywealth.com or by calling us on 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Production

Production