If you find yourself only paying attention to British news and politics, you may be missing out on information that could enrich your life.

Events happening in the UK might seem simpler and more relatable than stories you might read in the world news, yet ignoring what’s happening around the globe could mean you fail to gain potentially valuable knowledge.

Plus, if you focus purely on “home” matters, you might have a downbeat outlook on the near future.

The UK has endured several economic challenges over the past few years with:

- Inflation still relatively high

- Interest rates on the rise

- The International Monetary Fund (IMF) forecasting that the UK will be the only major global economy to shrink in 2023.

Yet, if you take a step back and take on a global outlook, you might discover some newfound positivity – such as the boom currently occurring in Japan.

The Japanese market has surged on the back of negative interest rates, low inflation, and a simplified marketplace

Both the Japanese economy and market are experiencing a bright start to 2023.

According to CNBC, Japan’s GDP rose 2.7% in the first quarter of the year – much higher than original forecasts – while Schroders reports that the TOPIX and the NIKKEI 225, Japan’s leading stock market indices, both surged to a 33-year high in May 2023.

There are multiple factors for the strong performance of the Japanese economy and stock market, but three that have probably contributed are:

- The Bank of Japan (BoJ), according to CEIC Data, setting a policy rate of -0.1%, a negative rate that discourages saving, while encouraging spending and investing (established in January 2016 and maintained since)

- Relatively low inflation in Japan, with Trading Economics reporting a drop to 3.2% in the year to the end of May 2023, slightly above the BoJ’s 2% target but a drop off from 4.3% in January

- Steps taken on 4 April 2022 to simplify and reorganise the traditionally complex Tokyo Stock Exchange (TSE).

Altogether, this helps to paint a positive picture for Japanese financial interests. However, if you lean towards having a “home bias” you’re unlikely to benefit from these potential gains.

Home bias might limit your investing outlook

Home bias refers to the tendency for investors to invest in domestic equities, while ignoring the possible benefits of diversifying into foreign equities.

It could limit your access to investing opportunities and could see you miss out on the potential to spread your risk.

So, taking the time to broaden your outlook, while considering moves to diversify your investments, could be a smart move.

Here are three valuable lessons the Japanese market can teach you about the problems presented by home bias, and how diversification might be the solution.

Lesson 1: Home bias could see you miss out on valuable opportunities elsewhere

Limiting your investments to just a domestic setting could severely restrict the investing opportunities available to you, such as benefiting from the recent boom in the Japanese market.

If you focus on investing all your funds in UK-based markets, you might miss out on potential long-term growth that you could gain from greater diversification.

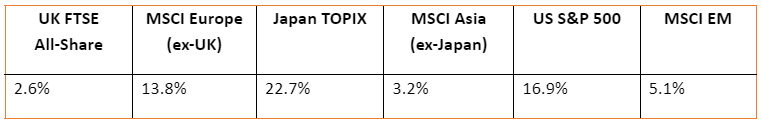

Markets around the world often perform differently to one another over the same period of time. The table below shows the average returns from the world’s leading stock indices in the year to 30 June 2023:

Source: JP Morgan

If you had all your funds tied up in UK markets over the past year, you would likely have missed out on the far greater average returns seen in Japan, Europe, or the US.

Although, it should be remembered that short-term changes in the marketplace are not necessarily indicative of long-term market trends.

That said, adopting a diversified approach to your investment portfolio could help you ensure that you benefit from potentially profitable surges in specific sectors or markets around the world.

Lesson 2: Home bias could see you exposed to more risk

One of the major issues with succumbing to home bias is that it might expose you to greater risk, especially if there is a sharp market downturn that leaves you with potential losses.

Japan is booming at the moment. But history has shown that markets can ebb and flow and in certain circumstances experience incredibly difficult periods.

In the 1970s and 80s, Japan was the envy of the western world as it continually surged to new economic heights. However, that came to an abrupt halt at the start of the 1990s when the Japanese equity and real estate bubble burst.

According to Investopedia, equity values dropped 60% between late 1989 and August 1992, while land value in Japan fell throughout the 1990s – declining 70% in value by 2001.

This gave rise to the term “the lost decade” in reference to Japan’s struggles throughout the 90s, which have had a lasting effect on Japanese markets and the greater economy in the decades since.

Had you only invested in Japanese companies, you might have seen a great deal of value wiped off your portfolio.

Remember: don’t put all your eggs in one basket. Diversifying into different countries and regions could give you the opportunity to generate returns elsewhere that help offset potential losses.

Lesson 3: Home bias could limit your understanding of the bigger picture

There is an old Japanese proverb that roughly translates as “a frog in a well never knows the vast ocean”.

In simple terms, it means that your understanding of the world is limited to your surroundings and vantage point, which might mean you’re unaware of the bigger picture.

It’s important to remember that in the 21st century, many major corporations are now international businesses and economies around the world are heavily interlinked.

Events elsewhere can set off a chain of dominos that may eventually lead to consequences closer to home.

A recent example being the Silicon Valley Bank crisis in the US and the subsequent effects on European and UK markets due to resulting widespread, yet thankfully short-lived, banking issues.

Seeing the bigger picture when investing, and ensuring you remain well-informed and up to date on global events, could help you grow your wealth over the long term.

Get in touch

If you are unsure about the best way to approach investing in international markets and are worried you might be prone to investing predominantly in UK markets, you might want to seek out professional advice.

Reach out to us by email mail@delaunaywealth.com or call 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production