Last year, we wrote about how recent events had affected mortgage interest rates and property prices, as the Bank of England (BoE)’s rising base rate pushed lenders to offer increasingly costly deals. These issues have continued into 2023.

It is naturally concerning, but it is important to remember there are possible solutions to any challenges you might face – remaining calm and working with a financial planner can help guide you past short-term issues.

The mortgage situation has prompted many to consider whether overpaying now, might be financially prudent in the long term. It is a step that could be worth considering, but one that shouldn’t be rushed into without seeking the necessary advice — here’s why.

3 benefits of overpaying on your mortgage today

1. You can pay off your debt sooner, reducing the overall cost and any interest owed

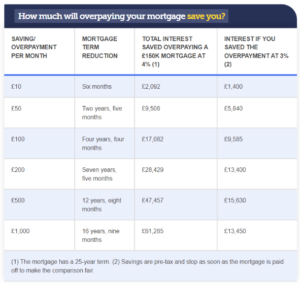

The savings produced by overpaying could be vast and may help towards ensuring you have enough set aside for your retirement plans.

The benefits are greater, the more you chose to overpay, a fact MoneySavingExpert details in the table below. This is based on a £150,000 mortgage over a 25-year term:

Source: MoneySavingExpert

If you have a regular cache of surplus funds and want to get eliminate sizeable mortgage payments from your regular outgoings, then overpaying could be a potential solution.

2. You can avoid being exposed to potentially higher variable rates if your fixed-rate agreement matures

Following the autumn statement, the UK mortgage market surged and average rates on offer rose above 6%.

For individuals on long-term fixed rates, which might have been agreed on historically low terms of 2% or less, the fear of their agreement maturing and being exposed to much higher rates could be a significant concern.

So, if the funds are available, it might be worth overpaying now while still benefiting from low fixed-rate terms before any changes come into effect. Although charges may apply.

However, even though interest rates in general have continued to rise this year — largely due to the BoE raising the base rate to 4% on 2 February 2023 — an overly competitive mortgage market has pushed lenders to reduce rates on offer below 4%.

So, it is important that you carefully consider the difference between your current terms and any changes in rates you might be exposed to before opting to overpay.

3. You might be able to remortgage on better terms to help you save in the long term

Overpaying can reduce your remaining debt quicker and might help you qualify for a lower loan-to-value (LTV) deal when your fixed rate comes to an end.

The LTV ratio refers to the size of your mortgage compared with the value of your property.

For example, if you borrow £360,000 in order to buy a home worth £400,000, the LTV is 90%, as you are borrowing 90% of the value of your property.

Lenders typically consider individuals with higher borrowing costs or a higher LTV to be a greater risk. So, the cheapest mortgages with the best terms are often offered to those with LTVs of 60% or below.

Overpaying on your debt now, might unlock a far better deal in the long run.

3 disadvantages to overpaying on your mortgage now

1. You might be hit with significant fees and charges

If you’re on a fixed-, tracker- or variable-rate mortgage deal, making overpayments could result in early repayment charges (ERCs).

ERCs are typically between 1% and 5% of the overall remaining balance on your agreement.

There can be some flexibility among lenders, such as:

- They might allow you to overpay by 10% each year during the initial tie-in period

- If you are on a tracker deal, or your lender’s standard variable rate (SVR), you may be allowed to overpay as much as you want without incurring any ERCs.

It is important that you carefully review the terms of your agreement before making any decisions.

2. You are likely to lose access to cash, which may be needed elsewhere

Once you’ve used your cash to overpay on your mortgage, it is gone. This means you won’t be able to use it elsewhere if needed.

This could lead to other pressing debts such as credit cards or loans mounting up. It may also leave you short of funds if the unexpected occurs.

It is advisable to have access to an emergency fund, ideally of between three to six months’ worth of essential bills, to provide for your crucial outgoings if the worst occurs.

Before opting to overpay on your mortgage, make sure you have the necessary safety net in place to protect you and your loved ones.

3. You could see greater benefits from keeping your money in savings or considering alternatives

Typically, the difference between the rates on savings accounts and mortgage agreements, means it may be more practical to use your funds to cover existing debts than save them in an account that might see your funds lose “real” value due to annual inflation.

However, rising interest rates and a competitive mortgage market have led to average savings rates being marginally higher than sub-4% mortgage rates, and prompted the possibility that retaining funds in savings might be more beneficial than overpaying.

Furthermore, alternatives such as investing your funds or contributing to your pension may have even greater benefits.

Get in touch

It all depends on your personal circumstances. A good first step could be discussing the situation with a financial planner and working out how overpaying on your mortgage might affect your long-term plans.

Reach out to us by email at mail@delaunaywealth.com or call us on 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Buy-to-let (pure) and commercial mortgages are not regulated by the FCA.

Think carefully before securing other debts against your home.

Production

Production