The FTSE 100, one of the UK’s leading stock indices, has provided a bright beacon for investors among the doom and gloom of recent times.

According to the Guardian, the index surpassed 8,000 points for the first time in February 2023, setting a new all-time record, despite ongoing recession worries.

It might be hard for potential investors to understand why the market is seemingly performing so well, while the greater economy struggles and many Brits face up to the challenges of the ongoing cost of living crisis.

Read on to learn why the FTSE is performing differently to the overall economy and four proven reasons why it continues to hit new highs.

1. The FTSE 100 is largely made up of traditional businesses in industries such as oil and gas, banking, and defence

While other global stock markets contain more modern businesses like tech firms — think Apple, Facebook, and Google — the FTSE 100 is largely made up of more traditional industries such as oil and gas, banking, agriculture, and defence.

These are all sectors that have thrived in recent times, especially due to the war in Ukraine and resulting shortages.

The FTSE 100 contains several major oil and gas companies, such as Shell, BP, and Centrica (the owner of British Gas).

Putin’s invasion of Ukraine in early 2022 prompted oil and gas prices to skyrocket and has largely contributed to the increasing household energy bills facing many British households today.

Following the age-old rule, as supplies dwindle and demand conversely increases, oil and gas prices have been pushed upwards.

According to the Guardian, shares in Shell and BP gained around 60% since the start of 2022 with both companies reporting record profits — BP more than doubling its earnings from 2021.

While crude oil and gas prices have started to fall in recent months, they are still historically high, energy firms are continuing to post bumper profits, and taxes on the businesses remain quite low, despite calls for harder windfall taxes.

2. The FTSE 100 contains major medical sector stocks that have been boosted by the pandemic

The onset of the Covid-19 pandemic pushed major pharmaceutical companies to pursue the largest and most rapid developments in vaccine technologies in living memory.

One of the globes leading vaccine suppliers is AstraZeneca with the UK-based firm becoming one of the most highly valued companies on the FTSE 100.

According to Simply WallSt, AstraZeneca saw 16.1% returns in the year to March 2023.

AstraZeneca has a vast range of drugs on the market, which continue to drive the company’s value upwards.

The index contains several successful medical sector businesses across drug development, private healthcare, and medical device production, which all continue to boost the FTSE 100’s overall performance.

3. The FTSE is made up of global companies that have actually benefited from a weak pound

The largest members of the FTSE 100 are multinational corporations whose sales and profits are derived from places around the world.

In fact, according to Investment Week, companies on the FTSE 100 receive approximately 75% of their revenues from overseas.

Major banking firms listed on the index, such as HSBC, rely on the performance of the global economy, not just the UK.

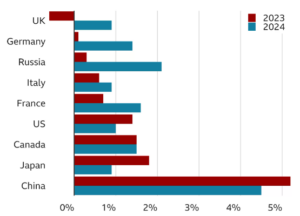

According to the BBC, the IMF predicts that the UK will be the only major global economy to enter recession in 2023, as other leading nations see growth in 2023 through to 2024, as shown by the graphic below:

Source: BBC

FTSE earnings are also influenced by fluctuations in the foreign exchange market, where the pound has depreciated against other major currencies such as the euro and US dollar over the last year. A weak pound can actually benefit the FTSE 100’s performance.

4. The outlook for the greater UK economy is rosier than previously thought

After 2022’s mini-Budget announcement, there were fears the Bank of England’s base rate could reach as high as 6% and inflation might surpass 13%.

However, in recent times, the outlook has looked rosier, despite ongoing concerns about a potential recession.

So far a recession has been avoided, inflation is believed to have peaked, and the base rate is forecast to stay below 4.5%.

The positive effect of this news — and the boost to UK businesses and investors — has helped push the FTSE higher.

However, it is important to remember that stock markets aren’t the economy, and any problems facing the UK economy as a whole, might not affect markets to the same degree.

Markets can ebb and flow on a regular basis. Yet, over the long run, they typically recover from short-term dips and continue to move in an upwards trajectory, as shown by the graph below:

Source: London Stock Exchange

So, it’s important to remember investing benefits from a long-term view, so while short-term positivity for UK markets can be good news, it shouldn’t necessarily have too much influence over your long-term investing strategy.

Get in touch

If you are looking to invest and are unsure over the right move for your long-term plans, especially during a volatile period for the UK economy, contact us at mail@delaunaywealth.com or call 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production