Stock markets, much like the news cycle, can ebb and flow. There can be:

- Quiet days, where nothing much happens

- Worrying days, where it’s important to stay positive in spite of concerning information

- Positive days that might give you hope for the future.

In fact, stocks and the news are often very interlinked, as global events such as the pandemic, war in Ukraine, and the cost of living crisis have all had their effect on markets.

When keeping up to date with the news, you’ll likely absorb a range of global and regional stories that pique your interest. Staying informed when investing can benefit you in the same way. It can help you better understand the opportunities and potential obstacles you and your financial planner might be dealing with.

It can also help you better understand the benefits of investing across global markets and various assets, known as “diversification”, which can be hugely beneficial for your long-term investing outcomes.

Here’s how global markets and various assets fared across 2022, and in 2023 so far, and why it underlines how vital diversification could be for your investments.

2022 was a difficult year for investors as global markets struggled

High inflation and rising interest rates put pressure on many global markets throughout 2022, creating a tricky environment for investors looking to make positive returns.

The table below details average annual returns across various leading global indices for 2022 and shows how many struggled.

Source: JP Morgan

While the UK’s FTSE All-Share managed to provide meagre positive returns for investors, many other global indices fell in value.

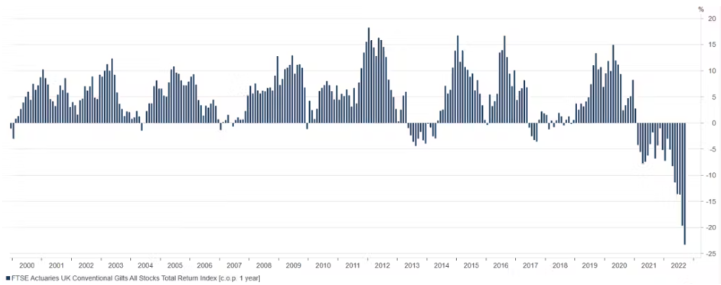

2022 was a particularly difficult year, as even traditional investing “safe havens”, such as government bonds, endured volatile periods. Nutmeg reports how sharp rises in interest rates and political instability destabilised certain global bond markets.

For example, UK government bonds saw their worst annual returns since 1998 and the largest drawdown on record, as shown by the chart below:

Source: Nutmeg

Economic difficulty was the theme of 2022 with Schroders describing it as “a year most investors would be glad to forget”. They report that most asset classes struggled last year with only a few commodities seeing generally positive returns.

It is a point supported by interactive investor, who found only 3 out of the 13 major asset classes they reviewed generated positive returns in the year to the end of November 2022. Yet, despite many classes struggling, commodities saw an average return of 22% for investors (US dollar terms).

Commodities include:

- Hard commodities, such as gold, silver, and oil

- Soft commodities, such as agricultural products like corn, wheat, and pork.

FTAdviser reports that commodities were the top performing asset in 2022, providing a welcome respite for investors from turmoil elsewhere.

2023 has offered investors reasons to be positive about the future

The year so far has shown how much markets can ebb and flow month-to-month and year-to-year. It is a helpful reminder that, while past performance is no guarantee of future results, markets do typically rebound from periods of instability.

Despite some short-term instability surrounding Silicon Valley Bank and its consequences for the banking sector, 2023 has seen largely positive returns for investors.

In fact, one of the UK’s leading stock indices, the FTSE 100, reached a new record high in the first quarter of 2023. It paints a rosier outlook for the future of UK investments, despite ongoing cost of living-related issues.

Further afield, the Japanese market is seeing a bullish year so far with its two leading stock market indices – the TOPIX and NIKKEI 225 – both surging to 33-year highs in May 2023.

Read more: Home bias and diversification – 3 useful lessons from the recent Japanese market boom

According to JP Morgan, Japan’s TOPIX and the US S&P 500 have seen average returns of 24.5% and 20.7% in the year to the end of July 2023, a stark change from their 2022 results.

So, 2022 was a difficult year, 2023 is offering renewed hope, but what will 2024, 2025, or 2026 bring? Global markets and asset values can shift gradually or dramatically month-to-month and year-to-year.

This is why diversification is so important for your investments.

Diversification helps reduce risk and could lead to greater long-term investment returns

Diversification involves spreading your investment funds across a variety of markets and asset classes. This strategy might help protect your investment portfolio from dips in certain areas by mitigating potential losses with gains elsewhere.

The opposite approach might see greater short-term returns if the handful of investments selected see a significant amount of growth. However, this “all your eggs in one basket” method could conversely lead to sizeable losses if your investments see a downturn.

For example, if you had all your funds tied up in the US S&P 500 in 2022 you could have seen average losses of 18.1%. Meanwhile, if you had diversified across global indices, the gains made by the FTSE All-Share, cash, or some commodities could have helped to mitigate these losses.

Working with a financial planner could help you ensure you develop a well-diversified portfolio of investments that are aligned with your goals and tolerance for risk.

The additional oversight an adviser could provide might also allow you to take a step back from actively managing your portfolio and free up valuable time to concentrate on your hobbies and loved ones.

Get in touch

If you’re interested in reviewing ways to ensure your portfolio is diversified and set up in the best way possible to generate long-term gains, it might be worth reaching out for professional advice.

We’re here to help guide you, so please email mail@delaunaywealth.com or call 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production