In life, you are likely to have a wide range of goals and aspirations.

You might seek to grow a business or succeed in your specific profession. You may have hobbies you want to master or places to visit. Alternatively, you may just want the gift of more time to spend with your loved ones.

Investing gives you the potential of achieving the kind of growth you need to give you the freedom to pursue those dreams. However, when you invest, you may have to navigate a range of taxes which could limit the growth you enjoy.

So, pursuing ways to invest in a tax-efficient manner could be an incredibly beneficial way to boost the value of your wealth.

Here are four options you might want to consider.

1. Invest for your eventual retirement through a pension

Pensions can be an incredibly tax-efficient way to save for your eventual retirement thanks to the generous Income Tax relief.

The Annual Allowance means you can contribute up to £60,000 into your pension (for the 2023/24 tax year) without incurring an additional tax charge. You can also carry forward any unused allowance you may have from the three previous tax years.

Pensions automatically benefit from tax relief on contributions at the basic rate of 20% while, if you’re a higher- or additional-rate taxpayer, you can claim additional relief through your self-assessment.

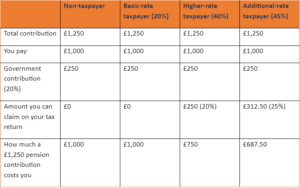

The tax benefits through investing in a pension could be significant for higher- or additional-rate taxpayers, as shown by the table below:

Source: interactive investor

Most pension schemes will then invest the funds you contribute to generate growth on your retirement savings. Any gains made on these investments are also exempt from Capital Gains Tax (CGT).

2. Government bonds are falling in value and could be a smart way to tax-efficiently invest

Warren Buffett, the billionaire investor, once said: “The best chance to deploy capital is when things are going down”.

The price of bonds has a direct inverse correlation with interest rates. If interest rates are rising, the price of bonds typically falls. Similarly, if interest rates drop, the price and value of bonds will likely increase.

At the moment, the UK, as well as many other leading nations, are experiencing periods of rising interest rates. As of 15 August 2023, the Bank of England (BoE) base rate is set at 5.25%. Some industry experts, such as Schroders, forecast it could reach as high as 6.5% in 2023.

This presents an opportunity to acquire UK government bonds at a relatively low price and benefit from an increase in their value once interest rates eventually begin to fall.

The Guardian reports that the UK inflation rate has continued its downwards trajectory in the year to July 2023, dropping to 6.8%. As the BoE’s base rate is largely raised as a means of combating and driving down inflation, it is likely interest rates will fall in the future.

Aside from the great opportunity for growth on an initial investment, most bonds sold in British pounds benefit from a CGT exemption, which could result in valuable tax relief. These include:

- Bonds issued by the UK government (gilts)

- HMRC-approved “qualifying corporate bonds” bought directly from the issuer and issued in pounds.

Although most other forms of bonds are likely to be liable for tax, they could also benefit from an exemption if they are held within an ISA or another form of tax wrapper.

3. ISAs could allow you to tax-efficiently invest for yourself or a loved one

ISAs are an incredibly attractive option if you’re looking to grow your wealth while reducing your potential tax liability.

There are two primary types of ISA, a Cash ISA and a Stocks and Shares ISA, each with their own rules and benefits.

As an investment option, a Stocks and Shares ISA offers you an opportunity to invest in a tax-efficient manner.

You could do this through a:

- Standard Stocks and Shares ISA up to the £20,000 subscription limit (2023/24 tax year).

- Junior ISA (JISA), an account opened for someone under the age of 18 and through which loved ones can save and invest on their behalf up to the subscription limit of £9,000 (2023/24).

- Lifetime ISA (LISA), provided you open the account before the age of 40. You can contribute up to £4,000 each year (2023/24) until the age of 50. You’ll receive a 25% government bonus of up to £1,000 each tax year (2023/24), although you will face a withdrawal penalty if you access the funds for anything other than to buy your first home before the age of 60.

Stocks and Shares ISAs (including JISAs and LISAs that are of this type) benefit from several forms of tax relief:

- Any gains made on investments within the ISA are free of both CGT and Income Tax.

- Any dividends paid from your ISA investments are normally free of Dividend Tax and won’t contribute towards your Dividend Allowance.

It is important to remember you can’t rollover any unused ISA allowance. So, if you want to take advantage of the tax benefits, it’s vital you use your full allowance, if you can afford to, before 5 April each year.

Read more: ISA investing – Here are 7 deadly sins you might want to avoid

4. The tax benefits of investing in Venture Capital Trusts and the Enterprise Investment Scheme could be especially attractive to high earners

Venture Capital Trusts (VCTs) and the Enterprise Investment Scheme (EIS) are usually seen as higher-risk investment opportunities. They also come with the possibility of sizeable growth over the lifetime of your investment.

VCTs are quoted private equity funds traded on the London Stock Exchange (LSE), while the EIS is a government-supported scheme designed to encourage investment in fledgling British companies.

While they both typically consist of small, start-up businesses seeking investment to achieve further growth, they also come with a greater risk of failure. This increases the potential for a loss on your initial investment.

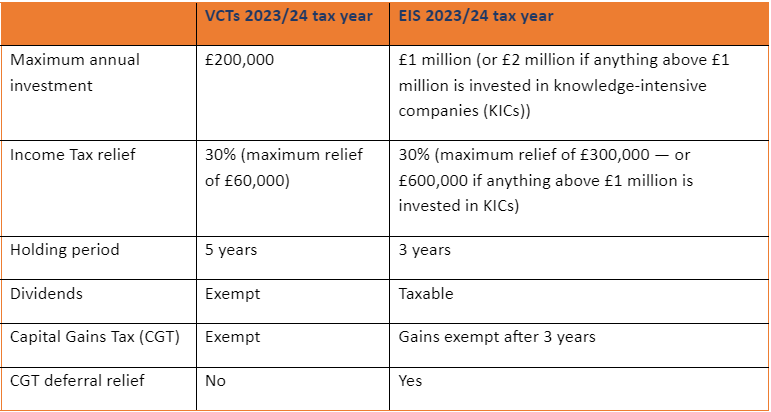

Beyond any investment growth, VCTs and the EIS could also benefit you with their attractive opportunities for tax relief, as shown by the table below:

The savings could be significant, especially if you’re a higher- or additional-rate taxpayer.

Read more: 2 valuable benefits of Venture Capital Trusts and the Enterprise Investment Scheme

Invest smart, invest tax-efficiently – get in touch for advice

If you’re considering new ways to invest your funds but are worried about any potential tax liabilities, a good first step could be to seek out professional advice.

Please email mail@delaunaywealth.com or call us on 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Enterprise Initiative Schemes (EIS) and Venture Capital Trusts (VCT) are higher-risk investments. They are typically suitable for UK-resident taxpayers who are able to tolerate increased levels of risk and are looking to invest for five years or more. Historical or current yields should not be considered a reliable indicator of future returns as they cannot be guaranteed.

Share values and income generated by the investments could go down as well as up, and you may get back less than you originally invested. These investments are highly illiquid, which means investors could find it difficult to, or be unable to, realise their shares at a value that’s close to the value of the underlying assets.

Tax levels and reliefs could change and the availability of tax reliefs will depend on individual circumstances.

Production

Production