Investing can be an incredibly beneficial way of generating the growth needed to help your clients reach their long-term goals. Yet, it can also come with its own set of risks.

Taking steps to gain a greater understanding of the potential challenges clients might face while improving their overall investing knowledge could ensure they stay on track.

Read on to discover six simple lessons your clients might want to keep in mind before making any major decisions regarding their investments.

1. Patience is a virtue

Your clients’ financial plans will normally have a long-term outlook with goals they seek to reach over periods of 10, 20, or 30 years. Your clients’ investments may benefit from a similarly patient view.

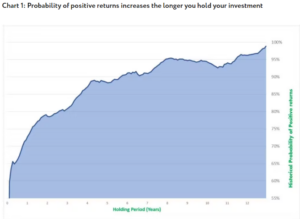

Nutmeg reports the probability of your clients seeing positive returns from their investments increases the longer they hold assets, as shown by the graph below:

Source: Nutmeg

While it is important your clients stay open-minded towards short-term opportunities, ensuring they retain a calm and measured mindset when viewing their investments and looking at their growth goals over long-term periods could be highly beneficial.

2. Beware of psychological biases and their effect on decision-making

There are a range of common psychological biases that may affect your clients’ decision-making, especially during stressful periods, such as during a market downturn.

For example, the theory of “loss aversion” posits that humans feel the pain of losses twice as much as the joys of gains.

In investing terms, when faced with the possibility of losses, your clients may opt to sell off their investments. This effectively locks in what was initially a paper loss and removes any possibility of their investment rebounding in value.

A quick look at the performance of the FTSE 100 over the 10-year period between August 2013 and 2023 underlines just how much the marketplace can ebb and flow over time, as shown by the graph below:

Source: London Stock Exchange

Markets often bounce back from periods of short-term instability. So, giving into fear and worry could result in your clients missing out on seeing their investment recover and potentially produce further gains.

3. View a market downturn as an opportunity

World-renowned billionaire investor, Warren Buffett, once said: “Bad news is an investor’s friend”.

While at first glance, a market downturn might be worrying for your clients, it could also present an opportunity.

When markets experience a downturn, typically high-value, blue-chip companies may see their share prices drop, which could allow your clients to acquire a greater holding for a reduced initial outlay.

So, as and when the markets start to recover, the value of your clients’ investment could significantly increase.

Adopting a positive outlook on their investments, even during uncertain periods, could see your clients reap the benefits over the long term.

4. Build a diversified portfolio

Investing inevitably comes with risk. As your clients’ adviser, we’ll seek to ensure any investments they make are aligned with their own tolerance for it.

One way to potentially reduce risk and mitigate against potential losses is to build a well-diversified investment portfolio.

This could involve your client spreading their funds across a variety of markets, stocks, and assets.

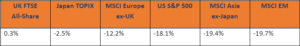

The table below details average annual returns across various leading global indices in 2022.

Source: JP Morgan

If your clients had all their investments tied up in the US market – the “all their eggs in one basket” approach – they might have seen losses throughout the year.

Yet, if they had spread their funds across multiple markets and commodities, they might have been able to mitigate these losses elsewhere.

Diversification is an incredibly simple step that could offer your clients some much-needed protection from any significant downturns in the marketplace.

5. Consider the benefits of investing tax-efficiently

Investing could lead to an increased liability for your clients through Capital Gains Tax (CGT) or Dividend Tax. So, taking steps to ensure they invest in a tax-efficient manner could provide them with a useful boost to their wealth.

There are a wide variety of tax-efficient investment vehicles your clients could choose to take advantage of, such as:

- Stocks and Shares ISAs

- Private or workplace pension schemes

- Government bonds

- Venture Capital Trusts and the Enterprise Investment Scheme.

The tax savings could be significant to your clients. For example, investments within Stocks and Shares ISAs are exempt from CGT, Dividend Tax, and typically aren’t liable for any Income Tax.

Read more: 4 reasons being more tax-efficient can boost your clients’ wealth

6. Consider investing rather than keeping too much in cash savings

It is important that before your clients opt to invest, they consider setting aside enough funds to provide for their outgoings in the case of an unexpected emergency.

This “rainy day” fund should ideally consist of between three to six months’ worth of essential bills, such as:

- Rent or mortgage payments

- Utility bills

- Regular commitments.

Once your clients have enough money saved away to provide for the worst-case scenario, and if they have a time horizon of at least five years, investing their surplus funds may give them the potential for growth.

Long-term, high inflation – such as that experienced in the UK over the past two years – can have an eroding effect on the “real” value of your clients’ hard-earned savings.

While savings rates are on the rise and are attractive at the moment – with Moneyfacts reporting best rates of 4.9% for easy access saving accounts (23 August 2023) – investing might still be a better option for providing your clients with the kind of returns needed to outpace inflation.

Read more: How to protect your clients’ money as long-term high inflation affects UK savers

Get in touch

Investing can offer your clients the potential for them to meet their long-term financial goals.

If your clients are looking to build a diversified, tax-efficient portfolio, they may want to seek out professional advice by emailing us at mail@delaunaywealth.com or calling 0345 505 3500.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production